Form Mo-1040 - Individual Income Tax Return - Long Form - 2007 Page 7

ADVERTISEMENT

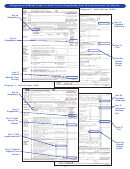

The total entered on Line 7 must equal 100

Do not enter your federal income tax

*Note: If you filed a Federal Form 1040EZ,

percent — round to the nearest percentage.

withheld as shown on your Form W-2(s) or

and checked one or both boxes on Line 5,

(Example: 84.3% would be shown as 84%,

federal return.

refer to the Standard Deduction Worksheet

and 97.5% would be shown as 98%.) Lines

for Dependents. If you did not check either

If you have an earned income credit, you

7Y and 7S must equal 100%.

box on Federal Form 1040EZ, Line 5, enter

must subtract the credit from the tax on

Note: If one spouse has negative income and

$5,350 if single or $10,700 if married.

your federal return. If a negative amount

the other spouse has positive income (example:

is calculated, enter “0”.

Itemized Deductions: If you itemized on

your income is –$15,000 and your spouse’s

income is $30,000), enter 0% on Line 7Y and

your federal return, you may want to item-

L

11 — O

F

T

INE

THER

EDERAL

AX

100% on Line 7S. If nothing is entered, the

ize on your Missouri return or take the stan-

Enter the total amount of Lines 45, 51, and 60

department will consider this to be 100%.

dard deduction, whichever results in a

and any recapture taxes included on Line 63

higher deduction. If you were required to

F

Y

IGURE

OUR

from Federal Form 1040. Enter the amount of

itemize on your federal return, you must

alternative minimum tax included on Line 28

T

I

itemize on your Missouri return. To figure

AXABLE

NCOME

of Federal Form 1040A. For amended returns

your itemized deductions, complete the

L

8 — P

S

enter the other taxes reported on Line 9c of

INE

ENSION AND

OCIAL

Form MO-A, Part 2. Attach a copy of your

Federal Form 1040X except: do not include

S

/S

S

federal return (pages 1 and 2) and Federal

ECURITY

OCIAL

ECURITY

self-employment tax, FICA tax, or railroad

Schedule A.

D

E

ISABILITY

XEMPTION

retirement tax on this line. Attach a copy of

If you or your spouse received public or

your federal return (pages 1 and 2). Attach a

L

15

16 —

INES

AND

private pension, social security and/or social

copy of Federal Forms 4255, 8611, or 8828

T

N

D

security disability, complete Form MO-A, Part

OTAL

UMBER OF

EPENDENTS

if claiming recapture taxes.

3. Enter the amount from Form MO-A, Part 3,

Do not include yourself or your spouse as

Total Exemption on MO-1040, Line 8. Attach

dependents.

L

13 — F

I

INE

EDERAL

NCOME

a copy of your federal return (pages 1 and 2),

T

D

Line 15—Multiply by $1,200 the total

Form 1099-R(s), Form W-2P(s), and/or Form

AX

EDUCTION

number of dependents you claimed on

SSA-1099(s). Failure to attach these copies

If you checked Box A, B, D, E, F, or G on

will result in the disallowance of your pension

Line 6c of your federal return.

Line 9, your federal tax deduction may not

exemption, social security exemption, and/or

exceed $5,000. If you checked Box C on

Line 16—Multiply by $1,000 the total

social security disability exemption.

Line 9, your federal tax deduction may not

number of dependents you claimed on

exceed $10,000.

L

9 — F

S

Line 15 that were age 65 or older by the

INE

ILING

TATUS AND

last day of the taxable year. Do not

E

A

L

14 — S

XEMPTION

MOUNT

INE

TANDARD OR

include dependents that receive state

Check the box applicable to your filing status.

I

D

TEMIZED

EDUCTIONS

funding or Medicaid. Attach a copy of

You must use the same filing status as on your

Standard Deductions: If you claimed the

your federal return (pages 1 and 2).

Federal Form 1040 with two exceptions:

standard deduction on your federal return,

1. Box B must be checked if you are claimed

L

17 — L

-

C

INE

ONG

TERM

ARE

enter the standard deduction amount for

as a dependent on another person’s

I

D

your filing status. The amounts are listed

NSURANCE

EDUCTION

federal tax return and you checked either

If you paid premiums for qualified long-

on Form MO-1040, Line 14.

box on Federal Form 1040EZ, Line 5; or

term care insurance in 2007, you may be

you were not allowed to check Box 6a on

If you or your spouse marked any of the

eligible for a deduction on your Missouri

Federal Forms 1040 or 1040A.

boxes for 65 or older, blind, or claimed as

income tax return. Qualified long-term

If you checked Box B, enter “0”.

a dependent, use the chart below.

care insurance is defined as insurance

2. Box E may be checked only if all of the

coverage for a period of at least 12 months

Federal Form

Line Numbers

following apply: a) you checked Box 3

for long-term care expenses should such

(married filing separate return) on your

1040

Line 40

care become necessary because of chronic

Federal Form 1040 or 1040A; b) your

health conditions and/or physical disabili-

1040A

Line 24

spouse had no income and is not

ties including cognitive impairment or the

required to file a federal return; and c)

1040EZ

See following note*

loss of functional capacity, thus rendering

your spouse was claimed as an exemp-

an individual unable to care for themself

1040X

Line 2

tion on your federal return and was not a

dependent of someone else. Note: You

must attach a copy of your federal return

W

L

-T

C

I

D

ORKSHEET FOR

ONG

ERM

ARE

NSURANCE

EDUCTION

to verify this filing status.

A. Enter the amount paid for qualified long-term care insurance

Only one box may be checked on Line 9, Boxes

policy. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A) $___________

A through G.

If you itemized on your federal return and your federal

Enter on Line 9 the amount of exemption

itemized deductions included medical expenses, go to Line B.

claimed for your filing status on Boxes A through

If not, skip to H.

G.

The

amounts

are

listed

on

Form

MO-1040. Attach a copy of your federal return.

B. Enter the amount from Federal Schedule A, Line 4. . . . . . . . . . . B) $___________

C. Enter the amount from Federal Schedule A, Line 1. . . . . . . . . . . C) $___________

L

10 — T

F

INE

AX

ROM

F

R

D. Enter the amount of qualified long-term care

EDERAL

ETURN

included on Line C. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D) $___________

Use the chart below to locate your tax on

your federal return.

E. Subtract Line D from Line C. . . . . . . . . . . . . . . . . . . . . . . . . . . . E) $___________

F. Subtract Line E from Line B. If amount is less

Federal

than zero, enter “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F) $___________

Form

Line Numbers

G. Subtract Line F from Line A. . . . . . . . . . . . . . . . . . . . . . . . . . . . G) $___________

1040

Line 57 minus Lines 45 and 66a

H. Enter Line G (or Line A if you did not have to complete

1040A

Line 35 minus Line 40a and

Lines B through G) on Form MO-1040, Line 17

any alternative minimum tax

included on Line 28

Attach a copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A

(if you itemized your deductions).

1040EZ

Line 10 minus Line 8a

1040X

Line 8c minus Line 13c

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44