Form Mo-1040 - Individual Income Tax Return - Long Form - 2007 Page 5

ADVERTISEMENT

If you marked Box 3 or 4 and claimed your

Missouri Home of Record—Entering or

Note: The tax rate for a composite return is

spouse as an exemption on Federal Form

Leaving the Military

6 percent. For more information, visit

1040NR, check Box E on Form MO-1040.

If you are entering or leaving the military,

Missouri is your home of record, and you

forms/composite.pdf.

If you marked Box 5 on Federal Form

spend more than 30 days in Missouri, your

1040NR; or Box 2 on Federal Form 1040NR-

C

’

U

T

ONSUMER

S

SE

AX

total income, including your military pay, is

EZ, check Box D on Form MO-1040.

Consumer’s use tax is a tax imposed on

taxable to Missouri.

If you marked Box 6 on Federal Form

goods purchased for storage, use, or con-

Non-Missouri Home of Record—Stationed

1040NR, check Box G on Form MO-1040.

sumption from out-of-state sellers who are

in Missouri

Itemized Deductions

not registered with the state of Missouri to

The military pay of nonresident military per-

Nonresident aliens who are required to item-

collect tax. Consumer’s use tax laws are

sonnel stationed in Missouri due to military

ize their deductions for federal purposes must

very similar to sales tax laws.

orders is not taxable to Missouri. Complete

also itemize deductions on their Missouri

Form MO-NRI only if you or your spouse

When you purchase tangible personal

return. For more detailed information, visit

did not have income, other than military

property outside the state of Missouri

pay, of $600 or more earned in Missouri (a

totaling more than $2,000 in a calendar

Missouri return is not required). However,

year, which Missouri use tax has not been

Federal Tax Deduction

income of $600 or more earned by you or

charged and collected by the seller, you

Enter on Form MO-1040, Line 10 the amount

your spouse in Missouri, other than military

are subject to the payment of use tax. You

from Federal Form 1040NR, Line 52 minus

pay, is taxable to Missouri. The nonresident

can download Form 4340, Consumer’s

Line 42; or the amount from Federal Form

military pay should be subtracted from your

Use Tax Return, at ,

1040NR-EZ, Line 15.

federal adjusted gross income on Form MO-

for more information. The due date for

Enter on Form MO-1040, Line 11 the amount

A, Part 1, Line 9, as a “Military (nonresi-

Form 4340 is April 15, 2008.

from Federal Form 1040NR, Lines 42, 46,

dent).” Form MO-NRI should also be

and 55.

T

B

R

AXPAYER

ILL OF

IGHTS

completed and attached to Form MO-1040.

To obtain a copy of the Taxpayer Bill of

Attach a complete copy of your federal

O

S

I

THER

TATE

NCOME

Rights, you can access our web site at

return and all supporting documentation.

You must begin the Form MO-1040 with

/personal/pubs.htm,

For all other lines of Form MO-1040, see

your total federal adjusted gross income, as

or call (800) 877-6881.

instructions starting on this page.

reported on your federal return.

Lines 1

through 25 of the return are computed as if

P

-Y

R

ART

EAR

ESIDENT

you are a full-year resident. Tax (Line 25) is

A part-year resident is treated as a nonresi-

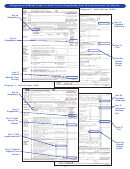

FORM MO-1040

computed on all your income, and may then

dent. However, a part-year resident may

be reduced by a resident credit (Line 26), or

determine tax as a resident for the entire

by a Missouri income percentage (Line 27).

year. A part-year resident may use Form

Information to Complete

The result is a prorated Missouri tax liability

MO-CR to take a credit for taxes paid to

(Line 28) based only on the income earned in

Form MO-1040

another state or Form MO-NRI to determine

Missouri. See page 8, Lines 26 and 27.

income percentages.

D

E

T

Important: Complete your

ECLARATION OF

STIMATED

AX

M

P

ILITARY

ERSONNEL

Residents and nonresidents are required to

federal return first.

The Servicemembers Civil Relief Act pre-

make a declaration of estimated tax if their

If you are filing a fiscal year return, indicate

vents military personnel from being taxed on

Missouri estimated tax is expected to be at least

the beginning and ending dates on the line

military income by any state other than their

$100. If you are required to make estimated

provided near the top of Form MO-1040.

home of record state.

tax payments, you must do so by remitting your

tax payment along with Form MO-1040ES,

Missouri Home of Record

N

, A

, E

.

AME

DDRESS

TC

Estimated Tax Declaration for Individuals.

If you entered the armed forces in Missouri,

If all the address information is correct on

Failure to file Form MO-1040ES and make

your home of record is presumed to be Mis-

timely payments will result in a penalty being

the preprinted label (if available), attach the

souri and you are presumed to be domiciled

charged on the underpaid amount.

label to the Form MO-1040 and print or

in Missouri.

type your social security number(s) in the

A

C

DDRESS

HANGE

Missouri Home of Record—Stationed Out-

spaces provided. If you did not receive a

If you move after filing your return, notify both

side Missouri

book with a peel-off label, or the label is in-

the post office serving your old address and

If you: (a) maintained no permanent living

correct, print or type your name(s), address,

the Department of Revenue of your address

quarters in Missouri during the year; (b)

and social security number(s) in the spaces

change. Address change requests should be

maintained permanent living quarters else-

provided on the return.

mailed to: Department of Revenue, P.O. Box

where; and (c) did not spend more than 30

If the taxpayer or spouse died in 2007,

2200, Jefferson City, MO 65105-2200. This

days of the year in Missouri; you are consid-

check the appropriate box and write the

will help forward any refund check or corre-

ered a nonresident for tax purposes and your

date of death after the decedent’s first name

spondence to your new address.

military pay, interest, and dividend income

in the name and address area of the return.

are not taxable to Missouri. Complete Form

C

R

If a refund is due to the deceased taxpayer,

OMPOSITE

ETURN

MO-NRI and attach to Form MO-1040.

attach a copy of Federal Form 1310 and

Businesses filing a composite return on

Note: If your spouse remains in Missouri

behalf of their nonresident partners or

death certificate.

more than 30 days while you are stationed

shareholders should use Form MO-1040.

Enter your county of residence and the

outside Missouri, your total income, includ-

Attach a schedule listing the name, address,

number of the public school district in

ing your military pay, is taxable to Missouri.

identification number, and amount of each

which you reside. See school district listing

Missouri Home of Record—Stationed in

nonresident partner and/or shareholder’s

on pages 42 and 43. (If you are a nonresi-

Missouri

income from Missouri sources to Form

dent, you should enter 347 for the school

If your home of record is Missouri and you

MO-1040. Write “composite return” at the

district number and “NONR” for the county.

are stationed in Missouri due to military

top of Form MO-1040. Refer to Missouri

If you were a part-year resident, enter the

orders, all of your income, including your

Regulation 12 CSR 10-2.190 for complete

Missouri school district number and county

military pay, is taxable to Missouri.

filing instructions.

in which you last resided.)

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44