Form Mo-1040 - Individual Income Tax Return - Long Form - 2007 Page 31

ADVERTISEMENT

Attachment Sequence No. 1040-02, 1120-04,

2007

1120S-02

MISSOURI DEPARTMENT OF REVENUE

FORM

MISCELLANEOUS INCOME

MO-TC

TAX CREDITS

NAME (LAST, FIRST)

SOCIAL SECURITY NUMBER/FEIN

SPOUSE’S NAME (LAST, FIRST)

SPOUSE’S SOCIAL SECURITY NUMBER/FEIN

CORPORATION NAME

MITS/MO I.D. NUMBER

CHARTER NUMBER

• Each credit will apply against your tax liability in the order they appear on the form.

• If you are claiming more than 10 credits, attach an additional sheet.

• If you are filing a combined return, both names must be on the certificate/form from the issuing agency.

USE THIS FORM TO CLAIM INCOME TAX CREDITS ON FORM MO-1040, MO-1120, MO-1120A, MO-1120S, OR MO-1041. ATTACH TO FORM MO-1040, MO-1120,

MO-1120A, MO-1120S, OR MO-1041.

• SPOUSE on a

• YOURSELF

BENEFIT

ALPHA

combined return

• one income

DOR

CODE

NUMBER

• corporation income

CREDIT NAME

USE

• corporation franchise

(Assigned by

(3 Characters)

• fiduciary

ONLY

DED only)

from back

Column 1

Column 2

00

00

1.

1

00

00

2.

2

00

00

3.

3

00

00

4.

4

00

00

5.

5

00

00

6.

6

00

00

7.

7

00

00

8.

8

00

00

9.

9

00

00

10.

10

00

00

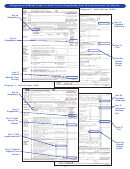

11. SUBTOTALS — add Lines 1 through 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12. Enter the amount of the tax liability from Form MO-1040, Line 30Y for yourself and Line 30S

for your spouse, or from Form MO-1120, Line 13 plus Line 14 for income or Line 15 for

00

00

franchise; Form MO-1120S, Line 16 for franchise tax; or Form MO-1041, Line 18. . . . . . . . . . . . . . 12

13. Total Credits — add amounts from Line 11, Columns 1 and 2. (Enter here and on Form MO-1120,

Line 17; Form MO-1120S, Line 17; Form MO-1040, Line 37; or Form MO-1041,

00

Line 19.) Line 13 cannot exceed the amount on Line 12, unless the credit is refundable. . . . . . . . . . . . . . . . . . . . . 13

MO 860-2274 (3-2008)

For Privacy Notice, see the instructions.

Instructions

• If you are a shareholder or partner and claiming a credit, you must attach a

copy of the shareholder listing, specifying your percentage of ownership.

• If you are filing an individual income tax return and you have only one

Benefit Number:

income, use Column 1.

Only the credits issued by the Department of Economic Development (DED)

• If you are filing a combined return and both you and your spouse have

will have a benefit number. The number is located on your Certificate of

income, use Column 1 for yourself and Column 2 for your spouse.

Eligibility Schedule (Certificate).

• If you are filing a fiduciary return, use Column 1.

Alpha Code:

• If you are filing a corporation income tax return, use Column 1. If you are

This is the three character code located on the back of the form. Each credit

filing a corporation franchise tax return, use Column 2.

is assigned an alpha code to ensure proper processing of the credit claimed.

I declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption,

credit or abatement if I employ such aliens.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44