Form Mo-1040 - Individual Income Tax Return - Long Form - 2007 Page 6

ADVERTISEMENT

A

62 T

64

The Internal Revenue Service (IRS) is not a

GE

HROUGH

FEDERAL FORM

LINE

state agency and debts owed to the IRS are

If you or your spouse were ages 62, 63, or

excluded from the non-obligated spouse

64 by December 31, 2007, check the

Federal Form 1040

Line 37

apportionment.

appropriate box as you may qualify for the

Federal Form 1040A

Line 21

social security deduction.

F

Y

M

IGURE

OUR

ISSOURI

Federal Form 1040EZ

Line 4

A

65

O

/

B

GE

OR

LDER AND

OR

LIND

A

G

I

DJUSTED

ROSS

NCOME

If you or your spouse were age 65 or older

Federal Form 1040X

Line 1C

Missouri requires the division of income be-

or blind and qualified for these deductions

tween spouses. Taxpayers filing a combined

on your 2007 federal return, check the ap-

Missouri Modifications

return pay less tax by dividing the income

propriate boxes.

Before completing Lines 2, 3, and 4, read the

between spouses and then determining the

Information to Complete Form MO-A, Part

tax amount for each person’s income.

100 P

D

P

ERCENT

ISABLED

ERSON

1, page 11.

You must begin your Missouri return with

You may check the 100 percent disabled

your total federal adjusted gross income,

box if you are unable to engage in any

L

2 — T

A

INE

OTAL

DDITIONS

substantial gainful activity by reason of

even if you have income from a state other

Enter the total additions amount from Form

any medically determinable physical or

than Missouri.

MO-A, Part 1, Line 6.

mental impairment that can be expected

L

1 — F

A

L

4 — T

S

to result in death or has lasted or can be

INE

EDERAL

DJUSTED

INE

OTAL

UBTRACTIONS

expected to last for a continuous period of

G

I

Enter the total subtractions amount from

ROSS

NCOME

not less than 12 months.

Form MO-A, Part 1, Line 13.

If your filing status is “married filing com-

A claimant is not required to be gainfully

bined” and both spouses are reporting in-

L

7 — I

P

INE

NCOME

ERCENTAGES

employed prior to such disability to qualify

come, use the worksheet below to split

To calculate your income percentage for

for a property tax credit. You may visit

income between you and your spouse. The

Line 7, complete the chart below if both

to learn more about

combined income for you and your spouse

spouses have income:

the property tax credit claim.

must equal the total federal adjusted gross

income you reported on your federal return.

N

-

S

Yourself

ON

OBLIGATED

POUSE

For all other filing statuses, use the chart in

Line 5Y _____________ divided by

You may check the non-obligated spouse

the next column to determine your federal

Line 6 _____________= _____________

box if your spouse owes the state of Mis-

adjusted gross income.

souri any child support payments, back

Spouse

If you include loss(es) of $1,000 or more

taxes, student loans, etc., and you do not

Line 5S _____________ divided by

on Line 1, you must attach a copy of

want your portion of the refund used to pay

Line 6 _____________= _____________

Federal Form 1040 (pages 1 and 2).

the amounts owed by your spouse.

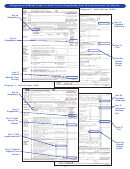

WORKSHEET FOR LINE 1 — Instructions for Completing the Adjusted Gross Income Worksheet

portion of the 2006 refund. Taxable social security benefits must be allocated

Missouri law requires a combined return for spouses filing together. A

combined return means taxpayers are required to split their total federal

by each spouse's share of the benefits received for the year.

adjusted gross income (including other state income) between spouses

The worksheet below lists income that is included on your federal return,

when beginning the Missouri return.

along with federal line references. Find the lines that apply to your federal

return, split the income between you and your spouse, and enter the

Splitting the income can be as easy as adding up your separate Form W-2s

and 1099s. Or it may require more calculating by allocating to each spouse

amounts on the worksheet. When you have completed the worksheet,

transfer the amounts from Line 18 to Form MO-1040, Lines 1Y and 1S.

the percentage of ownership in jointly held property, such as businesses,

farm operations, dividends, interest, rent, and capital gains or losses. State

Note: Remember, the incomes listed separately on Line 18 of this worksheet

refunds should be split based on each spouse's 2006 Missouri tax withheld,

must equal your total federal adjusted gross income when added together.

less each spouse's 2006 tax liability. The result should be each spouse's

Adjusted Gross Income Worksheet

Federal

Federal

Federal

S — Spouse

Y — Yourself

Form 1040EZ

Form 1040A

Form 1040

for Combined Return

Line Number

Line Number

Line Number

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . .

1

7

7

00

1

00

2. Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

8a

8a

00

2

00

3. Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

9a

9a

00

3

00

4. State and local income tax refunds . . . . . . . . . . . . . . . . . . .

none

none

10

00

4

00

5. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

11

00

5

00

6. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

12

00

6

00

7. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

10

13

00

7

00

8. Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

14

00

8

00

9. Taxable IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . .

none

11b

15b

00

9

00

10. Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . .

none

12b

16b

00

10

00

11. Rents, royalties, partnerships, S corporations, trusts, etc. . .

none

none

17

00

11

00

12. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

18

00

12

00

13. Unemployment compensation . . . . . . . . . . . . . . . . . . . . . .

3

13

19

00

13

00

14. Taxable social security benefits . . . . . . . . . . . . . . . . . . . . .

none

14b

20b

00

14

00

15. Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

21

00

15

00

16. Total (add Lines 1 through 15) . . . . . . . . . . . . . . . . . . . . . .

4

15

22

00

16

00

17. Less: federal adjustments to income . . . . . . . . . . . . . . . . . .

none

20

36

00

17

00

18. Federal adjusted gross income (Line 16 less Line 17)

Enter amounts here and on Lines 1Y and 1S, Form MO-1040

4

21

37

00

18

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44