Form Mo-1040 - Individual Income Tax Return - Long Form - 2007 Page 3

ADVERTISEMENT

Fiscal Year Filers

Social Security Number . . . . . . . . . . . . . .5

W

’

I

HAT

S

NSIDE

When to File . . . . . . . . . . . . . . . . . . . . . .4

Net Operating Loss . . . . . . . . . . . . . . .11, 12

Form MO-1040 Completion . . . . . . . . . .5

Non-obligated Spouse . . . . . . . . . . . . . . . . .6

Page

Forms Ordering . . . . . . . . . . . . . . . . . . .3, 44

Nonresident

Address Change . . . . . . . . . . . . . . . . . . . . .5

Income Tax

Adjusted Gross Income

Definition . . . . . . . . . . . . . . . . . . . . . . . .4

Local Earnings . . . . . . . . . . . . . . . . . . . .33

Federal . . . . . . . . . . . . . . . . . . . . . . . . . .6

Income Percentage . . . . . . . . . . . . . . . . .8

Paid to Other States (Resident Credit

Missouri . . . . . . . . . . . . . . . . . . . . . . . . .6

Partner or S Corp Shareholder . . . . . . . . .8

or Missouri Income Percentage) . . . . .8

Worksheet . . . . . . . . . . . . . . . . . . . . . . .6

Nonresident Alien . . . . . . . . . . . . . . . . . .4, 5

Percentage (Resident Credit or

Amended Return . . . . . . . . . . . . . . . . . . .4, 9

Part-year Resident . . . . . . . . . . . . . . . . . .5, 8

Missouri Income Percentage) . . . . . . .8

Amount Due . . . . . . . . . . . . . . . . . . . . . . .10

Pension Exemption . . . . . . . . . . . . .7, 33, 34

State . . . . . . . . . . . . . . . . . . . . . . . . .8, 33

Composite Return . . . . . . . . . . . . . . . . . . . .5

Individual Medical Accounts . . . . . . . .11, 12

Consumer’s Use Tax . . . . . . . . . . . . . . . . . .5

Property Tax Credit . . . . . . . . . . . . . .8,34-36

Credit Card Payment . . . . . . . . . . . . . . . . .10

Interest

Property Tax Credit Chart . . . . . . . . . .40, 41

Domicile . . . . . . . . . . . . . . . . . . . . . . . . . . .4

Exempt Federal Obligations . . . . . . . . .11

Railroad Retirement

Deductions

State and Local Obligations . . . . . . . . . .11

Benefits . . . . . . . . . . . . . . . . . . . . . .12, 34

Personal Exemption . . . . . . . . . . . . . . . .7

Internet Addresses . . . . . . . .2, 3, 4, 5, 6, 8, 9

Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Dependent . . . . . . . . . . . . . . . . . . . . . . .7

10, 33, 44

Tier I and Tier II . . . . . . . . . . . . . . . .12, 33

Elderly Dependent . . . . . . . . . . . . . . . . .7

Late Filing and Payment

Healthcare Sharing Ministry . . . . . . . . . .8

Recapture Tax . . . . . . . . . . . . . . . . . . . . . . .8

Additions . . . . . . . . . . . . . . . . . . . . . . . .4

Federal Income Tax . . . . . . . . . . . . . . . . 7

Interest . . . . . . . . . . . . . . . . . . . . . . . . . .4

Refund . . . . . . . . . . . . . . . . . . . . . . . . . . .10

Itemized . . . . . . . . . . . . . . . . . . . . . .7, 33

Payment Plan Request . . . . . . . . . . . . . . .4

Return Inquiry Web Site . . . . . . . . . . . .4, 44

Long-term Care Insurance . . . . . . . . . .7–8

1040V . . . . . . . . . . . . . . . . . . . . .4, 10, 37

Resident (definition) . . . . . . . . . . . . . . . . . .4

Standard . . . . . . . . . . . . . . . . . . . . . . . . .7

Lump Sum Distribution . . . . . . . . . . . . . . . .8

Resident Credit . . . . . . . . . . . . . . . . . . . . . .8

Depreciation Adjustment . . . . . . . . . . . . .33

Mailing Addresses . . . . . . . . . . . .2, 4, 10, 34

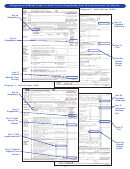

Diagrams of Federal Forms . . . . . . . . .38, 39

Self-employment Tax . . . . . . . . . . . . . . . .33

Military Personnel . . . . . . . . . . . . . . . . .5, 12

Disabled, 100 Percent . . . . . . . . . . . . . . . . .6

School District Numbers . . . . . . . . . . .42, 43

Missouri Taxpayer Bill of Rights . . . . . . . . . .5

Enterprise or Rural Empowerment

Signing Your Return . . . . . . . . . . . . . . . . .10

Missouri Withholding

Zone Income Modification . . . . . . . . . . .8

Form 1099 . . . . . . . . . . . . . . . . . . . . . . .8

Tax Credits . . . . . . . . . . . . . . . . . . . . . . . . .8

Estimated Tax

Form W-2 . . . . . . . . . . . . . . . . . . . . .8, 44

Tax Computation Worksheet . . . . . . . . . . .38

Declaration of . . . . . . . . . . . . . . . . . . . . .5

Modifications to Income . . . . . . . .11, 12, 33

Tax Table . . . . . . . . . . . . . . . . . . . . . . . . .38

Underpayment Penalty . . . . . . . . . . . . .10

MOST and/or Missouri Higher

Extension . . . . . . . . . . . . . . . . . . . . . . . . . .4

Telephone Numbers for Assistance . . . . . .44

Education Deposit Program . . . . . . .11, 33

Filing Requirements . . . . . . . . . . . . . . . .3, 4

Trust Funds . . . . . . . . . . . . . . . . . . . . . .9, 10

Name, Address, etc.

Filing Status . . . . . . . . . . . . . . . . . . . . . . . . .7

When to File . . . . . . . . . . . . . . . . . . . . . . . .4

Deceased Taxpayer . . . . . . . . . . . . . . . . .5

Do You Have the

c. Interest on federal exempt obligations;

If you qualify to use a short form, visit

d. Interest on state and local obligations;

to select the easiest

Correct Tax Book?

e. Capital gain exclusion;

form.

f. Exempt contributions made to or earn-

Form MO-1040 is Missouri’s long form. It is

To Obtain Forms:

ings from the Missouri Savings for Tui-

a universal form that can be used by anyone.

tion Program (MOST) and/or Missouri

• Access .

If you do not have any of the special filing

Higher Education Deposit Program;

• Call (800) 877-6881.

g. Enterprise zone or rural empower-

situations described below and you choose

• Visit Department of Revenue Tax Assis-

to file a paper tax return, try filing a short

ment zone modification;

tance Centers (page 44).

form. The short forms are less complicated

h. Negative adjustments related to the

and provide only the necessary information

bonus depreciation;

• Call the Forms-by-Fax System at (573)

for specific tax filing situations.

i. Net

operating

loss

carry-

751-4800 from your fax machine hand-

back/carryforward; and/or

set. The system will take you through the

YOU MUST FILE FORM MO-1040 IF ONE

j. Combat pay included in federal

steps to fax a copy of the forms you need.

OR MORE OF THE FOLLOWING APPLIES:

adjusted gross income.

• Write Department of Revenue, Customer

• You claim:

• You or your spouse have income from

Services Division, P.O. Box 3022, Jeffer-

a. A pension or social security/social

another state.

son City, MO 65105-3022.

security disability exemption and/or

• You are claiming a deduction for depen-

• TDD: (800) 735-2966 or fax (573) 526-1881.

property tax credit and you also have

dent(s) age 65 or older.

other special filing situations. (If you

If you need to obtain a federal form, you

• You owe a penalty for underpayment of

do not have any other special filing

can access the IRS web site at

estimated tax.

situations described in this section, you

• You are filing an amended return.

can use Form MO-1040P—Short Form

• You owe tax on a lump sum distribution

IMPORTANT FILING

to file your taxes and claim the prop-

included on Federal Form 1040, Line 44.

erty tax credit/pension exemption.);

• You owe recapture tax on low income

INFORMATION

b. Miscellaneous tax credits (taken on

housing credit.

Form MO-TC); and/or

• You are a nonresident entertainer or a

c. A credit for payment made with the

This information is for guidance only and

professional athlete.

filing of a Form MO-60, Application

does not state the complete law.

for Extension of Time to File.

• You are a fiscal year filer.

• You are nonresident military stationed in

F

R

ILING

EQUIREMENTS

• You have any of the following Missouri

Missouri and you or your spouse earned

You do not have to file a Missouri return if

modifications:

non-military income while in Missouri.

you are not required to file a federal return.

a. Positive or negative adjustments from

• You claim a deduction for other federal

partnerships, fiduciaries, S corpora-

If you are required to file a federal return, you

tax (from Federal Form 1040, Lines 45,

tions, or other sources;

may not have to file a Missouri return if you:

51, and 60 and any recapture taxes

b. Nonqualified distribution received

• are a resident and have less than $1,200

included on Line 63).

from the Missouri Savings for Tuition

of Missouri adjusted gross income;

• You claim a Healthcare Sharing Ministry

Program (MOST) and/or Missouri

Higher Education Deposit Program;

deduction.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44