Form Mo-1040 - Individual Income Tax Return - Long Form - 2007 Page 26

ADVERTISEMENT

2007 FORM MO-NRI

PAGE 2

PART C — MISSOURI INCOME PERCENTAGE

Yourself or One Income Filer

Spouse (on a Combined Return)

1. Missouri income — Enter wages, salaries, etc. from Missouri. (You must file a

00

00

Missouri return if the amount on this line is more than $600.) . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Taxpayer’s total adjusted gross income (from Form MO-1040, Lines 5Y and 5S

or from your federal form if you are a military nonresident

00

00

and you are not required to file a Missouri return). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3. MISSOURI INCOME PERCENTAGE (divide Line 1 by Line 2). If greater than 100%, enter

100%. (Round to a whole percent such as 91% instead of 90.5% and 90% instead of 90.4%.

However, if percentage is less than 0.5%, use the exact percentage.) Enter percentage here

and on Form MO-1040, Lines 27Y and 27S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

3

%

INSTRUCTIONS

PART A, LINE 1: NONRESIDENTS OF MISSOURI — If you are a Missouri nonresident and had Missouri source income, complete Part A, Line 1, Part B, and Part

C. Attach a copy of your federal return and this form to your Missouri return.

PART A, LINE 2: PART-YEAR RESIDENT — If you were a Missouri part-year resident with Missouri source income and income from another state; you may use

Form MO-NRI or Form MO-CR, whichever is to your benefit. When using Form MO-NRI, complete Part A, Line 2, Part B, and Part C. Missouri source income includes

any income (pensions, annuities, etc.) that you received while living in Missouri.

PART A, LINE 3: MILITARY NONRESIDENT TAX STATUS —

MISSOURI HOME OF RECORD — If you have a Missouri home of record and you and/or your spouse:

a) Did not have any Missouri income other than military income, were not in Missouri for more than 30 days, did not maintain a home in Missouri during the year,

but did maintain living quarters elsewhere, you qualify as a nonresident for tax purposes. Complete Part A, Line 3 and enter "0" on Part C, Line 1.

b) Did have Missouri income other than military income, were in Missouri for more than 30 days and/or maintained a home in Missouri during the year you cannot

use this form. You must file Form MO-1040 because 100% of your income is taxable, including your military income. Do not complete this form.

c) Did not have Missouri income other than military income but spent more than 30 days in Missouri and/or maintained a home in Missouri during the year you

must file Form MO-1040 because 100% of your income is taxable, including your military income. Do not complete this form.

MILITARY NONRESIDENT STATIONED IN MISSOURI — If you are a military nonresident, stationed in Missouri and you and/or your spouse:

a) Earned non-military income while in Missouri, you must file Form MO-1040. Complete Part A, Line 3, Part B and Part C. The nonresident military pay

should be subtracted from your federal adjusted gross income using Form MO-A, Part 1, Line 9, as a “Military (nonresident) Subtraction”.

b) Did not earn non-military income while in Missouri, complete Part A, Line 3, enter “0" on Part C, Line 1, and your federal adjusted gross income on Part

C, Line 2. You are not required to file a Missouri return. Sign this form below and send with your Leave and Earnings Statement (and all Form W-2s) to: Missouri

Department of Revenue, P.O. Box 3900, Jefferson City, MO 65105-3900.

NOTE: IF YOU FILE A JOINT FEDERAL RETURN, YOU MUST FILE A COMBINED MISSOURI RETURN (REGARDLESS OF WHOM EARNED THE INCOME).

COMPLETE EACH COLUMN OF PART B AND PART C OF THIS FORM. DO NOT COMBINE INCOMES FOR YOU AND YOUR SPOUSE.

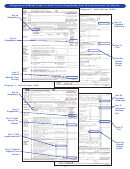

RESIDENT OR NONRESIDENT

Use this diagram to determine if you or your spouse are a

Are you domiciled* in Missouri?

1. Did you maintain a permanent

NO

YES

place of residency in Missouri?

1. Did you maintain a permanent

place of residency in Missouri?

2. Did you spend more than 30

days in Missouri?

2. Did you spend more than 183

days in Missouri?

YES

NO

to

to

YES

NO to either

either

both

to

Did you maintain a permanent place of

You are a

both

residency elsewhere?

Resident.

You are a

You are a

Nonresident

Resident.

You are a

NO

YES

Nonresident

(for tax

purposes).

You are a Resident.

*Domicile (Home of Record) — The place an individual intends to be his/her permanent home; a place that he/she intends to return whenever absent. A domicile, once estab-

lished, continues until the individual moves to a new location with the true intention of making his/her permanent home there. An individual can only have one domicile at a time.

Under penalties of perjury, I declare that I have examined this form and to the best of my knowledge and belief it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all

information of which he/she has any knowledge. As provided in Chapter 143, RSMo, a penalty of up to $500 shall be imposed on any individual who files a frivolous return.

SIGNATURE

DATE

SPOUSE’S SIGNATURE

DATE

MO 860-1096 (11-2007)

This form is available upon request in alternative accessible format(s).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44