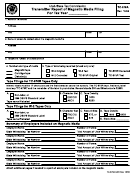

Form Tc-679a - Transmitter Report Of Magnetic Media Filing Page 5

ADVERTISEMENT

General Information

General Information

All entities that are required to withhold Utah state income tax or mineral production tax,

must provide the Tax Commission with an annual report (Form TC-96R) summarizing the

payments made to the Tax Commission. This report must be reconciled with the employees’

W-2 or the payees’ 1099-R or TC-675R. This pamphlet provides the instructions for report-

ing this information to the Utah State Tax Commission.

Filing Deadline

The required information must be submitted by February 28 of the next calendar year or the

next working day if the 28th falls on a Saturday, Sunday or a legal holiday.

To request an extension of time for the filing of withholding tax information, you must pro-

vide the Tax Commission with a written request explaining the reason(s) an extension of

time is needed. This request must be received by the filing due date.

Form 1099-R

The State of Utah does not require 1099-R filings unless Utah state income tax was with-

held. However, any payer who voluntarily withholds Utah state income tax from a recipient’s

retirement income is required to report this information to the Tax Commission using Form

TC-96R. Complete copies of the recipients’ 1099-R forms must be attached. Forms 1099-R

showing Utah withholding must be submitted on paper; magnetic media reporting is

not available.

Required Information

The summary of each employee’s or payee’s compensation reported on forms W-2 and TC-

675R may be filed on paper or magnetic media. Magnetic media is not available for 1099-R

forms, so they must be submitted on paper. Sufficient copies of the W-2, 1099-R, or TC-

675R forms must be furnished to each employee or payee to enable them to attach legible

copies to the individual’s state income tax return. The following information must be includ-

ed:

The payer’s name and address.

The payer’s federal identification number (FID).

The payer’s Utah withholding tax account number.

The payee’s name and address.

The payee’s social security number (SSN).

The payee’s federal compensation and withholding amounts.

The payee’s state compensation and withholding amounts.

Form TC-96R, Utah Employers Annual Reconciliation

The Tax Commission requires employers and payers to file Form TC-96R and to reconcile

the withholding amounts paid with the amounts reported on employees’ or payees’ W-2,

1099-R, or TC-675R. If the reconciliation indicates that additional money is owed to the

Page 1

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25