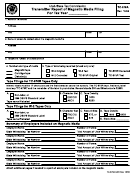

Form Tc-679a - Transmitter Report Of Magnetic Media Filing Page 8

ADVERTISEMENT

W-2 Data Record Descriptions for Magnetic Media

Corrections to Original Data

Corrections to the original W-2 or TC-675R data that has already been accepted and suc-

cessfully processed by the state can be submitted on paper forms or on magnetic media.

All corrections should be received no later than October 1 of the due date year. All correc-

tions should be accompanied by an amended TC-96R listing complete totals for the year

reported.

Requirements for Corrected Data

All fields must be completed with the correct information, not just the data fields that need

the corrections. The transmittal form TC-679A and an external label must accompany the

corrected magnetic media and must be clearly marked that it contains corrected data. Do

not put corrected data on a file that contains original data.

Follow the same format that is used for submitting the original data. If the error on the origi-

nal data is with any of the amount fields, only one transaction that provides all the correct

information is necessary. If the error made on the original return is an incorrect or missing

employee or payee SSN, name or address, then two separate transactions are required to

make the corrections properly. In the first transaction, enter the incorrect employee or payee

SSN, name and address and enter zero in all the amount fields. The second transaction will

have the correct employee or payee SSN, name and address with the correct amounts

entered in the amount fields.

Where to File Magnetic Media

Send all magnetic media along with the transmittal Form TC-679A and the reconcilia-

tion Form TC-96R to:

Magnetic Media Reporting

Utah State Tax Commission

210 North 1950 West

Salt Lake City UT 81434

On form TC-96R, Utah Employers Annual Reconciliation, indicate that the information was

filed on magnetic media.

W-2 Data Record Descriptions for Magnetic Media

The Tax Commission accepts the magnetic media format used by the SSA (Social Security

Administration). Therefore, a detailed description of the file layout is not attempted within

these instructions. If you are not familiar with the SSA magnetic media filing format,

you should refer to SSA’s publication TIB-4, Magnetic Media Reporting. The following

is a brief description of the records on the file.

Transmitter Record

Code A record on tape (codes1A and 2A on diskette) identifies the organization submitting

the file. This is the first and only occurrence of this record on the magnetic media.

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25