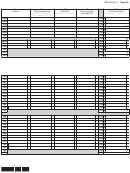

Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2012 Page 10

ADVERTISEMENT

Page 6a

CT-3-A (2012)

Legal name of corporation

Employer identification number

Computation of combined business allocation percentage

(use combined totals when dividing) (continued)

156

156 New York wages and other compensation of employees except general executive officers ...............................................

157

157 Total wages and other compensation of employees except general executive officers .......................................................

158

158 Combined New York State payroll factor

.......................................................

(divide line 156, column E, by line 157, column E)

159

159 Total combined New York State factors

...............................................................................

(add lines 141, 154, 155, and 158)

160 Combined business allocation percentage

...........................

(see instructions; enter here and in the boxes on line 21 and line 38)

160

Computation of combined business allocation percentage for trucking and railroad corporations

(use the combined totals when dividing)

161 New York revenue miles ........................................................................................................................................................

161

162 Total revenue miles .................................................................................................................................................................

162

163 Combined New York business allocation percentage

....................................

163

(divide line 161, column E, by line 162, column E)

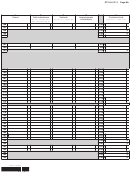

Computation of combined alternative business allocation percentage for combined MTI base

(use the combined totals when dividing)

If the companies in the combined group are not qualified foreign air carriers or principally engaged in the activity of an air freight

forwarder acting as principal or like indirect air carrier, complete only lines 177 through 189 and enter on line 195 the receipts factor

computed on line 189. The receipts factor is the alternative business allocation percentage.

164 New York real estate owned...................................................................................................................................................

164

165 Total real estate owned .........................................................................................................................................................

165

166 New York real estate rented ..................................................................................................................................................

166

167 Total real estate rented ..........................................................................................................................................................

167

168 New York inventories owned .................................................................................................................................................

168

169 Total inventories owned ........................................................................................................................................................

169

170 New York tangible personal property owned ........................................................................................................................

170

171 Total tangible personal property owned .................................................................................................................................

171

172 New York tangible personal property rented .........................................................................................................................

172

173 Total tangible personal property rented ................................................................................................................................

173

174 Total New York property

...............................................................................................

174

(add lines 164, 166, 168, 170, and 172)

175 Total property everywhere

175

............................................................................................

(add lines 165, 167, 169, 171, and 173)

176 Combined New York State property factor

...................................................

176

(divide line 174, column E, by line 175, column E)

177 Sales of tangible personal property allocated to New York State .........................................................................................

177

178 Total sales of tangible personal property ..............................................................................................................................

178

179 New York services performed ...............................................................................................................................................

179

180 Total services performed .......................................................................................................................................................

180

181 New York rentals of property .................................................................................................................................................

181

182 Total rentals of property ........................................................................................................................................................

182

183 New York royalties .................................................................................................................................................................

183

184 Total royalties ........................................................................................................................................................................

184

185 Other New York business receipts ........................................................................................................................................

185

186 Total other business receipts ................................................................................................................................................

186

187 Total New York receipts

.....................................................................................................

187

(add lines 177, 179, 181, 183, and 185)

188 Total receipts everywhere

188

..............................................................................................

(add lines 178, 180, 182, 184, and 186)

189 Combined New York State receipts factor

.....................................................

189

(divide line 187, column E, by line 188, column E)

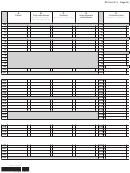

190 Combined New York State additional receipts factor

..................................................................................

190

(see instructions)

191 New York wages and other compensation of employees except general executive officers ...............................................

191

192 Total wages everywhere and other compensation of employees except general executive officers ...................................

192

193 Combined New York State payroll factor

.......................................................

193

(divide line 191, column E, by line 192, column E)

194 Total combined New York State factors

194

...............................................................................

(add lines 176, 189, 190, and 193)

195 Combined alternative business allocation percentage

195

.................................................................................

(see instructions)

434010120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14