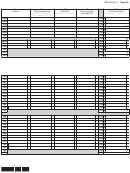

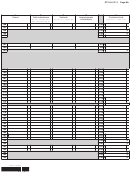

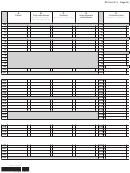

Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2012 Page 4

ADVERTISEMENT

Page 3a

CT-3-A (2012)

Legal name of corporation

Employer identification number

Computation of combined minimum taxable income (MTI) base

42 Combined ENI from line 17 ........................................................................................................................................................

42

Adjustments

(see instructions)

43 Depreciation of tangible property placed in service after 1986

43

.......................................................................

(see instructions)

44 Amortization of mining exploration and development costs paid or incurred after 1986 ..........................................................

44

45 Amortization of circulation expenditures paid or incurred after 1986

......................................

45

(personal holding companies only)

46 Basis adjustments in determining gain or loss from sale or exchange of property ...................................................................

46

47 Long-term contracts entered into after February 28, 1986 .......................................................................................................

47

48 Installment sales of certain property ..........................................................................................................................................

48

49 Merchant marine capital construction funds .............................................................................................................................

49

50 Passive activity loss

50

.......................................................................................

(closely held and personal service corporations only)

51 Add lines 42 through 50, column E ............................................................................................................................................

51

Tax preference items

(see instructions)

52 Depletion ....................................................................................................................................................................................

52

53

53

54 Intangible drilling costs ..............................................................................................................................................................

54

55 Add lines 51 through 54, column E ............................................................................................................................................

55

56 Combined New York NOLD from line 13 ...................................................................................................................................

56

57 Total

............................................................................................................................................................

57

(add lines 55 and 56)

58 Combined alternative net operating loss deduction (ANOLD)

58

.........................................................................

(see instructions)

59 Combined MTI

......................................................................................................................................

59

(subtract line 58 from 57)

60 Combined investment income before apportioned NOLD

...................................................................

60

(add line 18 and line 214)

61 Combined investment income not included in ENI but included in MTI ...................................................................................

61

62 Combined investment income before apportioned ANOLD

......................................................................

62

(add lines 60 and 61)

63 Apportioned combined New York ANOLD

.......................................................................................................

63

(see instructions)

64 Combined alternative investment income before allocation

64

..........................................................

(subtract line 63 from line 62)

65 Combined alternative business income before allocation

65

..............................................................

(subtract line 64 from line 59)

66 Allocated combined alternative business income

.......

66

(multiply line 65 by

%

from line 128, line 163, or line 195)

67 Allocated combined alternative investment income

..................................

67

(multiply line 64 by

from line 199)

%

68 Allocated combined MTI

68

.............................................................................................................................

(add lines 66 and 67)

69 Optional depreciation adjustment from line 23, column E ........................................................................................................

69

70 Combined MTI base

........................................................................................................................

70

(line 68 plus or minus line 69)

71 Tax on combined MTI base

71

......................................................................

(multiply line 70 by the appropriate rate; see instructions)

434004120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14