Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2012 Page 12

ADVERTISEMENT

Page 7a

CT-3-A (2012)

Legal name of corporation

Employer identification number

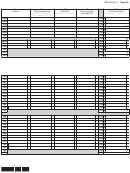

Computation of combined investment capital and investment allocation percentage

(see instructions)

196 Section 1 - Corporate and governmental debt instruments ...................................................................................................... 196

A Average value

..................................................................................................................................................

A

(see instructions)

B Liabilities directly or indirectly attributable to investment capital

B

.....................................................................

(see instructions)

C Net average value

..............................................................................................................................

C

(subtract line B from line A)

D Net average value allocated to New York State ..............................................................................................................................

D

197 Section 2 - Corporate stock, stock rights, stock warrants, and stock options ......................................................................... 197

A Average value

..................................................................................................................................................

A

(see instructions)

B Liabilities directly or indirectly attributable to investment capital

.....................................................................

B

(see instructions)

C Net average value

..............................................................................................................................

C

(subtract line B from line A)

D Net average value allocated to New York State ..............................................................................................................................

D

198 Total Section 1 and Section 2 .................................................................................................................................................... 198

A Average value

.....................................................................................................................................

A

(add lines 196A and 197A)

B Liabilities directly or indirectly attributable to investment capital

B

.......................................................

(add lines 196B and 197B)

C Net average value

...............................................................................................................................

C

(add lines 196C and 197C)

D Net average value allocated to New York State

.........................................................................................

D

(add lines 196D and 197D)

199 Combined investment allocation percentage

................................. 199

(divide line 198D by line 198C; use to compute lines 20, 37, 67)

200 Cash (optional) ........................................................................................................................................................................... 200

201 Combined investment capital

................................................................................ 201

(add lines 198C, column E, and 200, column E)

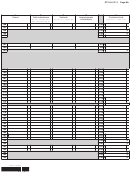

Computation of combined investment income for allocation

202 Interest income from investment capital, listed on line 196, Section 1

............................................................ 202

(see instructions)

203 Interest income from bank accounts

........................................................................................... 203

( if line 199 is zero, enter 0 here)

204 All other interest income from investment capital ..................................................................................................................... 204

205 Dividend income from investment capital ................................................................................................................................. 205

206 Net capital gain or loss from investment capital........................................................................................................................ 206

207 Investment income other than interest, dividends, capital gains or capital losses ................................................................... 207

208 Total combined investment income

................................................................................................... 208

(add lines 202 through 207)

209 Interest deductions directly attributable to investment capital ................................................................................................ 209

210 Noninterest deductions directly attributable to investment capital ......................................................................................... 210

211 Interest deductions indirectly attributable to investment capital ............................................................................................ 211

212 Noninterest deductions indirectly attributable to investment capital ...................................................................................... 212

213 Balance

..................................................................... 213

(subtract the sum of lines 209 through 212, column E, from line 208, column E)

214 Apportioned New York combined NOLD ................................................................................................................................... 214

215 Combined investment income before allocation

.................................... 215

(subtract line 214 from line 213; enter here and on line 18)

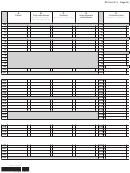

Computation of income from combined subsidiary capital

(see instructions)

216 Interest from combined subsidiary capital

................................................................................................................ 216

(attach list)

217 Dividends from combined subsidiary capital

............................................................................................................ 217

(attach list)

218 Capital gains from combined subsidiary capital

............................................................................... 218

(see instructions; attach list)

219 Total income from combined subsidiary capital

........................................... 219

(add lines 216 through 218; enter here and on line 10)

Computation and allocation of combined subsidiary capital base and tax

(see instructions for lines 220

through 223) Include corporations (except a DISC) in which you own more than 50% of the voting stock. Do not include

the value of any subsidiaries included in the combined return.

220 Average value ............................................................................................................................................................................ 220

221 Liabilities directly or indirectly attributable to subsidiary capital ............................................................................................... 221

222 Net average value

........................................................................................................................ 222

(subtract line 221 from line 220)

223 Net average value allocated to New York State ........................................................................................................................ 223

224 Combined subsidiary capital base tax

.......................................... 224

(multiply line 223, column E, by .0009; enter here and on line 76)

434012120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14