Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2012 Page 2

ADVERTISEMENT

Page 2a

CT-3-A (2012)

Legal name of corporation

Employer identification number

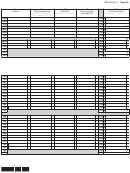

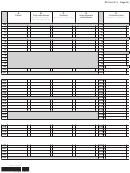

Computation of combined entire net income (ENI) base

1 Federal taxable income before net operating loss (NOL) and special deductions

(include disallowed dividends

•

.......................................................................................................................

1

paid deduction:

)

2 Interest on federal, state, municipal, and other obligations not included on line 1 ...................................................................

2

3 Interest paid to a corporate stockholder owning more than 50% of issued and outstanding stock ........................................

3

4a Interest deductions directly attributable to subsidiary capital .................................................................................................

4a

4b Noninterest deductions directly attributable to subsidiary capital ..........................................................................................

4b

5a Interest deductions indirectly attributable to subsidiary capital ..............................................................................................

5a

5b Noninterest deductions indirectly attributable to subsidiary capital .......................................................................................

5b

6 New York State and other state and local taxes deducted on your federal return

..........................................

6

(see instructions)

7 Federal depreciation deduction from Form CT-399, if applicable

....................................................................

7

(see instructions)

8 Other additions

...................................................

8

•

IRC section 199 deduction:

(see instructions)

9 Add lines 1 through 8, column E ................................................................................................................................................

9

10 Income from subsidiary capital

10

............................................................................................................................

(from line 219)

11 Fifty percent of dividends from nonsubsidiary corporations

............................................................................

11

(see instructions)

12 Foreign dividends gross-up not included on lines 10 and 11 ....................................................................................................

12

13 Combined New York net operating loss deduction (NOLD)

13

..............................................

(attach federal and NYS computations)

14 Allowable New York depreciation from Form CT-399, if applicable

.................................................................

14

(see instructions)

•

15 Other subtractions

S-11

................................................................................

15

(see instructions)

16 Total subtractions

...................................................................................................................

16

(add lines 10 through 15, column E)

17 Combined ENI

17

.............................................................................................

(subtract line 16 from line 9; enter here and on line 42)

18 Combined investment income before allocation

.............................................

18

(from line 215, but not more than line 17, column E)

19 Combined business income before allocation

.................................................

19

(subtract line 18, column E, from line 17, column E)

•

20 Allocated combined investment income

%

20

..................................................

(multiply line 18 by

from line 199)

•

21 Allocated combined business income

%

...................................

21

(multiply line 19 by

from line 128, 160, or 163)

22 Total combined allocated income

...............................................................................................................

22

(add lines 20 and 21)

23 Optional depreciation adjustments

23

..................................................................................................................

(see instructions)

24 Combined ENI base

.........................................................................................................

24

(line 22 plus or minus line 23, column E)

25 Combined ENI base tax

...

25

(multiply line 24 by the appropriate tax rate from the Tax rates schedule in the instructions; enter here and on line 72)

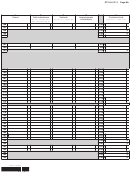

Computation of combined capital base

(use average values and enter whole dollars for lines 26 through 31; see instructions)

26 Total assets from federal return .................................................................................................................................................

26

27 Real property and marketable securities included on line 26 ....................................................................................................

27

28 Subtract line 27 from line 26 ......................................................................................................................................................

28

29 Real property and marketable securities at fair market value ...................................................................................................

29

30 Adjusted total assets

..................................................................................................................................

30

(add lines 28 and 29)

31 Total liabilities .............................................................................................................................................................................

31

32 Total combined capital

.....................................................................................

32

(subtract line 31, column E, from line 30, column E)

33 Combined subsidiary capital from line 222, column E; if none, enter 0 ....................................................................................

33

34 Combined business and investment capital

34

...................................................................................

(subtract line 33 from line 32)

35 Combined investment capital from line 201, column E; if none, enter 0 ...................................................................................

35

36 Combined business capital

.............................................................................................................

36

(subtract line 35 from line 34)

37 Allocated combined investment capital

•

...................................................

37

(multiply line 35 by

%

from line 199)

38 Allocated combined business capital

38

•

.....................................

(multiply line 36 by

%

from line 128, 160, or 163)

39 Combined capital base

...............................................................................................................................

39

(add lines 37 and 38)

40 Combined capital base tax

..............................................................................................................................

40

(see instructions)

41 Combined issuer’s allocation percentage

.....................................................

41

(see instructions; enter here and on line B on page 1)

434002120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14