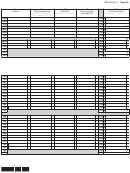

Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2012 Page 6

ADVERTISEMENT

Page 4a

CT-3-A (2012)

Legal name of corporation

Employer identification number

Computation of tax

72 Tax on combined ENI base from line 25 ......................................................................................

72

73 Tax on combined capital base from line 40

(see instructions)

(if new small business, mark an X in applicable box: first year

73

second year

)

Fixed dollar minimum tax

(see instructions)

74a New York receipts

..........................................

74a

(see instructions)

74b Fixed dollar minimum tax

74b

..........................................................

(for the corporation filing this form)

75 Amount from line 71, 72, 73, or 74b, whichever is greatest

75

..............................

(see instructions)

76 Combined subsidiary capital base tax from line 224 ..................................................................

76

77 Combined tax due before credits

.................................................................

77

(add lines 75 and 76)

78 Tax credits

78

..........................................................................................................

(see instructions)

79 Balance

.............................................................................................

79

(subtract line 78 from line 77)

80 Amount from line 71 or line 74b, whichever is greater ................................................................

80

81 Combined franchise tax

81

.....................................................................................

(see instructions)

82 Number of subsidiaries:

Number of taxable subsidiaries:

82

See instructions before completing lines 83a and 83b

83a Sum of fixed dollar minimum (FDM) taxes from all subsidiaries with a FDM over $1,000 ..........

83a

83b Sum of FDM taxes from all subsidiaries with a FDM of $1,000 or less .......................................

83b

84 Total combined tax due

......................................................................

84

(add lines 81, 83a, and 83b)

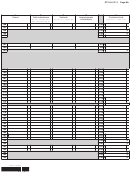

First installment of estimated tax for next period:

85a If you filed a request for extension, enter amount from Form CT-5.3, line 5 ...............................

85a

85b If you did not file Form CT-5.3 and the total of lines 81 and 83a is over $1,000, see instructions .....

85b

86 Add line 84 and line 85a or 85b ....................................................................................................

86

87 Total prepayments from line 108 .................................................................................................

87

88 Balance

........................................

88

(subtract line 87 from line 86; if line 87 is more than line 86, enter 0)

89 Estimated tax penalty

........

89

(see instructions; mark an X in the box if Form CT-222 is attached)

90 Interest on late payment

90

....................................................................................

(see instructions)

91 Late filing and late payment penalties

...............................................................

91

(see instructions)

92 Balance

....................................................................................................

92

(add lines 88 through 91)

Voluntary gifts/contributions

:

(see instructions)

00

93a Return a Gift to Wildlife ........................................................

93a

00

93b Breast Cancer Research & Education Fund .........................

93b

00

93c Prostate Cancer Research, Detection, and Education Fund

93c

00

93d 9/11 Memorial .......................................................................

93d

00

93e Volunteer Firefighting & EMS Recruitment Fund ..................

93e

94 Balance due

(if line 87 is less than the total of lines 86, 89, 90, 91, and 93a through 93e, enter the

94

.....................

difference here. This is the amount due; enter the payment amount on line A on page 1)

95 Overpayment

(if line 87 is more than the total of lines 86, 89, 90, 91, and 93a through 93e, enter the

..................................................................................

95

difference here. This is the amount overpaid)

96 Amount of overpayment to be credited to next period ...............................................................

96

97 Balance of overpayment

97

...................................................................

(subtract line 96 from line 95)

98 Amount of overpayment to be credited to Form CT-3M/4M .......................................................

98

99 Refund of overpayment

....................................................................

99

(subtract line 98 from line 97)

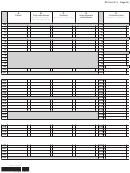

100a Refund of unused tax credits

100a

...................................

(see instructions and attach appropriate forms)

100b Tax credits to be credited as an overpayment to next year’s return

...............................................................................

100b

(see instructions and attach appropriate forms)

434006120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14