Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2012 Page 7

ADVERTISEMENT

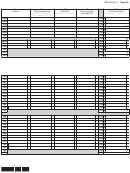

CT-3-A (2012) Page 4b

Summary of credits claimed on line 78 against current year’s franchise tax

(see instructions for lines 78, 100a and 100b, 101a and 101b)

CT-38 ...

CT-242 ......

CT-603 ......

CT-634 ................

CT-40 ...

CT-243 ......

CT-604 ......

CT-635 ................

CT-41 ...

CT-246 ......

CT-605 ......

DTF-619 .............

CT-43 ...

CT-248 ......

CT-606 ......

DTF-621 .............

CT-44 ...

CT-249 ......

CT-607 ......

DTF-622 .............

CT-46 ...

CT-250 ......

CT-611 ......

DTF-624 .............

CT-47 ...

CT-259 ......

CT-611.1 ...

DTF-630 .............

CT-236 ..

CT-261 ......

CT-612 ......

Servicing

mortgages credit ...

CT-238 ..

CT-601 ......

CT-613 ......

Other credits .........

CT-239 ..

CT-601.1 ...

CT-631 ......

CT-633 ......

CT-241 ..

CT-602 ......

If you claimed the QEZE tax reduction credit and you had a 100% zone allocation factor, mark an X in the box ..............................

101a Total credits listed above

101a

(enter here and on line 78; attach appropriate form or statement for each credit claimed)

101b Total refund eligible tax credits

101b

(see instructions; the amount of the credit claimed as a refund should be shown only on line 100a)

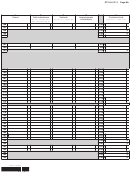

Composition of prepayments included on line 87

Date paid

Amount

(see instructions)

102 Mandatory first installment of combined group .....................................................

102

103a Second installment of combined group from Form CT-400 ................................... 103a

103b Third installment of combined group from Form CT-400 ....................................... 103b

103c Fourth installment of combined group from Form CT-400 ..................................... 103c

104 Payment with extension request, from Form CT-5.3, line 8 ...................................

104

105 Overpayment credited from prior years .......................................................................................... 105

Period

106 Overpayment credited from Form CT-3M/4M

..................... 106

107 Total prepayments from subsidiaries not previously included in the combined return

107

(from Form(s) CT-3-A/C)

108 Total prepayments

............................................. 108

(add lines 102 through 107; enter here and on line 87)

109 Interest deducted in computing federal taxable income ..............................................................

109

110 If the IRS has completed an audit of any of your returns within the last five years, list years:

111 If a member of an affiliated federal group, enter name of primary corporation and EIN:

Name

EIN

112 If more than 50% owned by another corporation, enter name of parent corporation and EIN:

Name

EIN

113 Corporations organized outside New York State, complete the following for capital stock issued and outstanding:

Number of par shares

Value

Number of no-par shares

Value

$

$

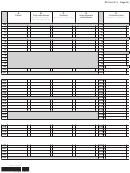

Interest paid to shareholders

114

Did this corporation make any payments treated as interest in the computation of ENI to shareholders

owning directly or indirectly, individually or in the aggregate, more than 50% of the corporation’s issued

and outstanding capital stock (mark an X in the appropriate box)? If Yes, complete the following and mark

114

............................................

an X in the appropriate box on line 115

(if more than one, attach separate sheet)

Yes

No

Shareholder’s name

Social security number or EIN

Interest paid to shareholder

Total indebtedness to shareholder described above

Total interest paid

115 Is there written evidence of the indebtedness? ............................................................................

115

Yes

No

116a Is the combined group claiming small business taxpayer status for lower ENI tax rates? .......... 116a

Yes

No

116b If you marked Yes on line 116a, enter total capital contributions

......................

116b

(see instructions)

117a Is the combined group claiming qualified New York manufacturer status for lower capital base

117a

Yes

No

tax limitation?

.................................................

(see instructions; mark an X in the appropriate box)

117b Is the combined group claiming qualified New York manufacturer status for lower ENI tax rates?

117b

.........................................................................

Yes

No

(see instructions; mark an X in the appropriate box)

117c Is the combined group claiming eligible qualified New York manufacturer status for lower tax

rates?

117c

Yes

No

(see instructions; mark an X in the appropriate box) ......................................................................

434007120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14