Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2012 Page 8

ADVERTISEMENT

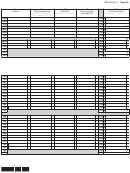

Page 5a

CT-3-A (2012)

Legal name of corporation

Employer identification number

Computation of combined business allocation percentage for aviation corporations

(use the combined totals when dividing)

118a New York aircraft arrivals and departures (

) ............................................................................................... 118a

revenue flights only

118b Adjusted New York aircraft arrivals and departures (

................................. 118b

)

revenue flights only

(multiply line 118a by 60% (.60))

119 Total aircraft arrivals and departures (

) .......................................................................................................

119

revenue flights only

120 Combined New York aircraft arrivals and departures percentage

................

120

(divide line 118b, column E, by line 119, column E)

121a New York revenue tons handled ............................................................................................................................................ 121a

121b Adjusted New York revenue tons handled

.............................................................................. 121b

(multiply line 121a by 60% (.60))

122 Total revenue tons handled ....................................................................................................................................................

122

123 Combined New York revenue tons handled percentage

123

..............................

(divide line 121b, column E, by line 122, column E)

124a New York originating revenue ................................................................................................................................................ 124a

124b Adjusted New York originating revenue

.................................................................................. 124b

(multiply line 124a by 60% (.60))

125 Total originating revenue ........................................................................................................................................................

125

126 Combined New York originating revenue percentage

126

...................................

(divide line 124b, column E, by line 125, column E)

127 Total combined New York percentages

.......................................................................................

127

(add lines 120, 123, and 126)

128 Combined New York business allocation percentage

.......................................................................

(divide line 127 by three)

128

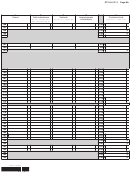

Computation of combined business allocation percentage

(use combined totals when dividing)

Are the companies in the combined group qualified foreign air carriers, or principally engaged in the activity of an air freight forwarder

acting as principal or like indirect air carrier?

) ....................................................................................Yes

No

(see instructions

If No, complete only lines 142 through 154 and enter on line 160 the receipts factor computed on line 154. The receipts factor is the

business allocation percentage.

129 New York real estate owned...................................................................................................................................................

129

130 Total real estate owned .........................................................................................................................................................

130

131 New York real estate rented ..................................................................................................................................................

131

132 Total real estate rented ..........................................................................................................................................................

132

133 New York inventories owned ................................................................................................................................................. 133.

134 Total inventories owned ........................................................................................................................................................

134

135 New York tangible personal property owned ........................................................................................................................

135

136 Total tangible personal property owned ................................................................................................................................

136

137 New York tangible personal property rented .........................................................................................................................

137

138 Total tangible personal property rented ................................................................................................................................

138

139 Total New York property

.................................................................................................

139

(add lines 129, 131, 133, 135, and 137)

140 Total property everywhere

140

..............................................................................................

(add lines 130, 132, 134, 136, and 138)

141 Combined New York State property factor

.....................................................

(divide line 139, column E, by line 140, column E)

141

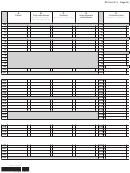

142 Sales of tangible personal property allocated to New York State .........................................................................................

142

143 Total sales of tangible personal property ..............................................................................................................................

143

144 New York services performed ...............................................................................................................................................

144

145 Total services performed .......................................................................................................................................................

145

146 New York rentals of property .................................................................................................................................................

146

147 Total rentals of property ........................................................................................................................................................

147

148 New York royalties .................................................................................................................................................................

148

149 Total royalties ........................................................................................................................................................................

149

150 Other New York business receipts ........................................................................................................................................

150

151 Total other business receipts ................................................................................................................................................

151

152 Total New York receipts

.....................................................................................................

152

(add lines 142, 144, 146, 148, and 150)

153 Total receipts everywhere

153

..............................................................................................

(add lines 143, 145, 147, 149, and 151)

154 Combined New York State receipts factor

.....................................................

154

(divide line 152, column E, by line 153, column E)

155 Combined New York State additional receipts factor

..................................................................................

(see instructions)

155

(continued)

434008120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14