Wv/bcs-Small - West Virginia Small Business Investment And Jobs Expansion Tax Credit Page 13

ADVERTISEMENT

the applicable year in the space provided.

Line b (2).

Enter your annual credit allowance for investments placed into service during the second taxable year (if applicable). Include

any annual credit allowance for which a yearly computation was required.

Line b (3).

Enter your annual credit allowance for investments placed in service during the third taxable year (if applicable). Include any

annual credit allowance for which a yearly computation was required.

Line b (4).

Add the amounts on lines b (1), b (2), and b (3) and enter the result on line 4. This is the amount of credit available for the

current year. Note, this credit is only available to taxpayers who obtain a multiple year project certification from the Tax

Commissioner. All others must use the instructions for line a to compute their credit. Depending upon the type of credit period,

(i.e., single year or multiple year), the amount on line a or b, whichever is applicable, will be used in Part IV to reduce up to

eighty percent (80%) of the tax liability, for certain taxes, that is attributable to and the direct result of the qualified investment.

Line c.

After completing Part IV and Part V, enter any rebate amount remaining to be carried forward from the respective years.

Rebate credit carried forward should be taken beginning with the earliest credit year.

Line d.

Enter the amount of deferred tax credit from Tax Credit Computation Schedule, line g, Column 9 for each applicable tax period.

Section 2

Line 1.

Enter the amount from Part VII, Section 1 line a or line b (4).

Line 2.

Enter the amount from Part IV line g, Column 5.

Line 3.

Enter the amount from Part V, Section 2, line e.

Line 4.

Enter the amount from Part V, Section 2, line f.

Line 5.

Enter the amount from Part IV, line g, Column 7.

Line 6.

Enter the sum of lines 3 and 4, minus line 5.

Line 7.

Enter the amount from Tax Credit Computation Schedule, Part IV, line g, Column 9. The deferred credit(s) may offset up to

100% of tax liability directly attributed to the qualified investment and new jobs in the tenth, eleventh, and twelfth tax years

subsequent to the year such investment is placed into service or use.

Line 8.

Enter the amount of deferred credit applied. Provide detailed information for taxable year(s) and amounts that gives rise to the

deferred credit being used in the tenth, eleventh, and twelfth tax years subsequent to the year such investment is placed into

service or use.

Line 9.

Enter the amount of available free-up credit, Part VI, line 9.

Line 10.

Enter the amount of available free-up credit applied for the current taxable year from Part IV, Column 12, line g.

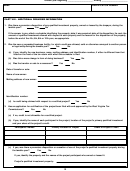

PART VIII

This part of the credit schedule must be completed, all questions answered and information provided.

Failure to do so will result in a delay or could result in the disallowance of the credit claimed on the tax returns.

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28