Wv/bcs-Small - West Virginia Small Business Investment And Jobs Expansion Tax Credit Page 8

ADVERTISEMENT

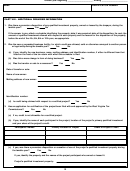

SECTION 2

PAYROLL FACTOR COMPUTATION

Line 1. Enter the amount of compensation paid to employees hired as a result of the new investment.

Line 2. Enter the amount of compensation paid to all West Virginia employees.

Line 3. Divide line 1 by line 2 and round to six decimals. Enter result on Part IV, Column 2.

SECTION 3

AFFILIATED COMPANIES OR CONTROLLED GROUP

AFFILIATES

The term affiliates includes all concerns which are affiliates of each other when either directly or indirectly owned, the concern controls

or has the power to control both. In determining whether concerns are independently owned and operated and whether or not affiliation exists,

consideration shall be given to all appropriate factors, including common ownership, common management and contractual relations.

CONCERN

The term concern means any business entity organized for profit (even if its ownership is in the hands of a nonprofit entity), having a

place of business located in this State, and which makes a contribution to the economy of this State through payment of taxes, or the sale

or use in this State of tangible personal property, or the procurement or providing of services in this State, or the hiring of employees who work

in this State.

CONTROLLED GROUP OF CORPORATIONS

For purposes of these regulations, the term controlled group of corporations means any group of corporations which is either a

parent-subsidiary controlled group, a brother -sister controlled group, or a combined group.

Parent - subsidiary controlled group - One or more chains of corporations connected through stock ownership with a common

parent corporation if stock possessing at least fifty percent (50%) of the combined voting power of all classes of stock.

Brother - sister controlled group - The term brother - sister controlled group means two or more corporations if the same

five or fewer persons who are individuals, estates, or trusts own (directly or indirectly) singly or in combination, stock possessing at least fifty

percent (50%) of the total combined voting power of all classes of stock.

Combined Group - The term combined group means any group of three or more corporations, if each corporation is a member

of either a parent - subsidiary controlled group of corporations or a brother - sister controlled group of corporations, and at least one of such

corporations is the common parent of a parent - subsidiary controlled group and also is a member of a brother - sister controlled group.

Section 3, enter the names of the affiliated companies or member of the controlled group along with the FEIN Number of each.

SECTION 4

ANNUAL PAYROLL

Line 1.

Enter the payroll of all firms operating on a full-year basis during the preceding year.

Line 2a. Enter the total payroll of all firms operating on a partial year basis during preceding year.

Line 2b. Enter the amount of payroll in line 2-a divided by the number of weeks in operation including the fractions.

Line 2c. Enter the amount in line 2-b multiplied by 52 weeks.

Line 3.

Enter the sum of lines 1 and 2-c.

SECTION 5

ANNUAL GROSS RECEIPTS

Line 1.

Enter the gross receipts for each year the firm was in operation during the preceding three years.

(Complete line 2 (a-d) if firm was in operation for less than three (3) complete fiscal years).

Line 2 (a). Enter the total gross receipts for the entire period in operation.

Line 2 (b). Enter the number of weeks, including the fraction of a week, firm was in operation.

Line 2 (c). Line 2 (a) divided by line 2 (b).

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28