Wv/bcs-Small - West Virginia Small Business Investment And Jobs Expansion Tax Credit Page 19

ADVERTISEMENT

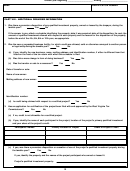

Taxable year beginning ______________________, Ending _______________________

NAME

IDENTIFICATION NUMBER

SMALL BUSINESS CREDIT

With the annual income tax return, for each year of the ten year credit period, the taxpayer shall certify:

(1) The new jobs percentage for this taxable year.

(2) The amount of the credit allowance for this taxable year.

(3) If a partnership or small business corporation (S-Corporation), the amount of credit allowed to the partners or shareholders for

this tax year.

(4) That the qualified investment property continues to be used, or, if disposed of, the date of disposition and that the disposition was

not prior to the expiration of its useful life.

(5) That the new jobs created by the qualified investment continue to exist and are filled by persons who meet the definition of new

employee and whose annual compensation equals or exceeds the minimum average compensation required for this credit.

These credits are allowable for a period of ten (10) years. Unused rebate credit may be carried forward for three (3) additional tax years

beyond the ten (10) year period.

The ten (10) year period begins with the taxable year in which the qualified investment property is placed in service or use, or at the taxpayer’s

election, the next succeeding taxable year. For the small business investment and jobs expansion credit, this election must be made on the

income tax return filed for the taxable year in which the property was placed in service or use.

Has taxpayer elected to begin the ten (10) year period with the next succeeding taxable year?

Yes

No

PART III

Section 1. COMPUTATION OF SMALL BUSINESS INVESTMENT AND JOBS EXPANSION TAX CREDIT (Quantifiable)

1.

Total qualified investment (From Part I, Section 4, line d).

2.

New jobs percentage (See Information below).

3.

Total allowable credit (line 1 x line 2).

.10

4.

Taxable year percentage.

5.

Annual credit allowance (line 3 x line 4).

Section 2.

CALCULATION OF SMALL BUSINESS INVESTMENT AND JOBS EXPANSION TAX CREDIT (Non-quantifiable)

1.

Total qualified investment (From Part I, Section 5, line (d), column (3)).

2.

New jobs percentage (See Information below).

3.

Total allowable credit (line 1 x line 2).

.10

4.

Taxable year percentage.

5.

Annual credit allowance (line 3 x line 4).

6.

Annual credit allowance for such qualified investments prior year(s).

7.

Credit allowance this taxable year (line 5 plus line 6).

Annual new jobs percentage: If at least ten (10) new jobs are created and filled during the taxable year in which the qualified investment

is placed in service or use, the applicable percentage is thirty percent (30%). Add to this percentage, 1/2 of 1% for each additional new job over

ten (10), but less than or equal to fifty (50) jobs.

The new job percentage is redetermined for each of the remaining nine (9) years of the ten (10) year credit period. The annual percentage

is based on the average number of new employees, in new jobs created as a direct result of the qualified investment, during each of the taxable

years.

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28