Wv/bcs-Small - West Virginia Small Business Investment And Jobs Expansion Tax Credit Page 23

ADVERTISEMENT

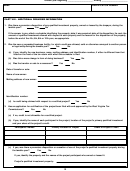

Taxable year beginning ______________________, Ending _______________________

NAME

IDENTIFICATION NUMBER

PART V - REBATE

Section 1. Determination of Maximum Rebate Allowable

Total West Virginia

Liability Eligible

Maximum

X

Rebate Amount

Liability

For Rebate

Column 1

Column 2

Column 3

Column 4

(a)

Ad valorem property tax paid on property

attributable to the qualified investment

.80

(b)

Unemployment Compensation Tax paid

.80

(c)

Workers' Compensation Premium paid

.20

(d)

TOTAL Maximum Rebate Allowable

Current Year

Section 2. Rebate to be applied in current tax year

(a) Annual credit allowance available Part VII, Section 1, line (a)(1) or

line (b) (4). ....................................................................................................................

(b) Amount of credit applied Part IV line (g) Column (5). .............................................

(c) Amount of credit remaining line (a) less line (b). ....................................................

(d) Maximum rebate allowable current year Part V, Section 1, line (d). .....................

(e) Rebate available current year Lesser of line (c) or line (d). ...................................

(f) Rebate from prior years Part VII, Section 1, line c (16). .........................................

(g) Total available rebate line (e) plus line (f). ...............................................................

(h) Amount of applied rebate Part IV, line (g), Column 7. ............................................

(i) Rebate carried forward line (g) less line (h). ...........................................................

NOTE: Unused rebate credit may be carried forward for three additional tax years beyond the ten year period.

6

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28