Wv/bcs-Small - West Virginia Small Business Investment And Jobs Expansion Tax Credit Page 18

ADVERTISEMENT

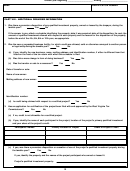

Taxable year beginning ______________________, Ending _______________________

NAME

IDENTIFICATION NUMBER

Section 4.

Annual Payroll Questionnaire Calculations

1.

Total payroll of all firms operating on a full year basis during preceding year.

2.

Total payroll adjusted.

a.

Total payroll of all firms operating on a partial year basis during preceding year.

b.

Amount of payroll in 2(a) divided by number of weeks in operation (include

fractions of weeks)

c.

Adjusted payroll (Amount in 2(b) multiplied by 52 weeks)

3.

Sum of full year and partial year payroll.

Section 5.

Annual Gross Receipts

1.

Annual gross receipts of all firms operating on a full-year basis during the preceding

three (3) years (see Instructions).

a.

Year 1

(19

)

b.

Year 2

(19

)

c.

Year 3

(19

)

d.

Highest gross receipts from a, b, or c.

2.

Annual gross receipts of all firms in operation for less than three (3) complete fiscal

years.

a.

Total gross receipts, less deductions, for the entire period in operation.

b.

Number of weeks (including fractions) in operation.

c.

Total gross receipts 2(a) divided by number of weeks 2(b).

d.

Derived "Annual Gross Receipts" - Total calculated in 2(c) multiplied by fifty two

(52).

Section 6.

Median Annual Compensation

*Median Annual Gross Compensation

*Arrange the annual compensation amount of each employee in an hierarchy ranking such amounts from lowest to highest, then

select the middle number.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28