Wv/bcs-Small - West Virginia Small Business Investment And Jobs Expansion Tax Credit Page 21

ADVERTISEMENT

P A R T

P A R T

I V

I V

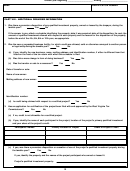

Name ____________________________________________

Identification Number ______________________________ Taxable year beginning ______________________, Ending _____________________

TAX CREDIT COMPUTATION SCHEDULE

=

x

Type

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

(13)

of

Liability

Payroll

Tax

Tax Subject

Amount of

Tax Subject

Amount of

Col. 5 + Col.7

Deferred Credit

Col. 8 - Col. 9

Tax Eligible

Free-up

Total

Tax

Factor

Attributable

To Credit

Credit Applied

To Rebate

Rebate Applied

(Col. 8 x 20%)

for Free-up

Credit

Credits

To Investment

(Col. 3 - Col.4)

Credit

Applied

(Col. 10 + Col.

(Col. 3 - Col. 10)

12)

(a)

Business &

.80

Occupation

Tax

(b)

Severance

.80

Tax

(c)

Tele-

.80

communication

Tax

(d)

Business

.80

Franchise

Tax

(e)

Corporation

.80

Net Income

Tax

(f)

Personal

Income

.80

Tax on Net

Income From

Business

Activity

(g)

Total

* Credit against Severance Tax may only be claimed if the qualified investment was placed into service or use prior to January 1, 1990 or if the taxpayer qualified under one of the transition rules of W. Va. Code § 11-13C-14 and filed a WV/BCS-SEV on or before July

2, 1990.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28