Wv/bcs-Small - West Virginia Small Business Investment And Jobs Expansion Tax Credit Page 9

ADVERTISEMENT

Line 2 (d). Line 2 (c) multiplied by fifty two (52) weeks. (This is the derived Annual Gross Receipts).

SECTION 6

MEDIAN ANNUAL COMPENSATION

Arrange the annual compensation amount of each employee in a hierarchy ranking such amounts from lowest to highest, then select the

middle number.

*Information as to required certification is included on the computation schedule immediately following Part II.

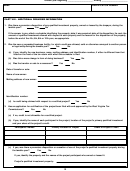

PART III - COMPUTATION OF CREDITS

SECTION l

COMPUTATION OF SMALL BUSINESS INVESTMENT AND JOBS EXPANSION TAX CREDIT

(Quantifiable Investment)

Line 1. The amount of the qualified investment was determined in Part I. Enter the amount from Part 1, Section 4, line (d).

Line 2. For Small Business Investment and Jobs Credit, the new jobs percentage is based on the number of new jobs created in this

State that are directly attributable to the qualified investment in a new or expanded business facility located in West Virginia.

The hours of part-time employees may be aggregated to determine the number of equivalent full time employees for the purpose of

determining the applicable new jobs percentage, but not for the purpose of determining when a job is attributable to the qualified investment

for use in the tax apportionment payroll fraction to be shown in Part IV of this schedule.

A job is attributable to the qualified investment if:

1.

The employee’s service is performed or his base of operations is at the new or expanded facility.

2.

The position did not exist prior to the making of the investment in the new or expanded facility.

3.

The position exists only because of the investment in the new or expanded facility.

The number of new jobs created by the investment is determined by the net increase in employment by the business in West Virginia.

The hours of part-time employees may be aggregated to determine the number of equivalent full-time employees for the purpose of

ascertaining the number of new jobs created.

The determination of the number of new jobs created by the investment is made each year beginning with the first year in which qualified

investment is placed in service or use. A small business taxpayer is allowed a credit for a qualified investment in a new or expanded business

facility in this State that results in the creation of at least ten (10) new jobs.

Enter on line 2 the applicable new jobs percentage.

Line 3. Multiply the amount on line 1 by the percentage on line 2. This is the total allowable credit.

Line 4. The allowable credit is taken over a ten (10) year period, one-tenth each taxable year. The credit period begins with the taxable

year in which the qualified investment is placed in service or use, in West Virginia, or with the next succeeding tax year. In either event, the

taxable year percentage is ten percent (.10).

Line 5. Multiply the amount on line 3 by ten percent (.10). The result is the amount of credit for the taxable year.

SECTION 2

CALCULATION OF SMALL BUSINESS INVESTMENT AND JOBS EXPANSION TAX CREDIT

(Nonquantifiable Investment)

If you have included, as part of your qualified investment, property for which the cost is not ascertainable at the time the property is placed

in service or use, (Part 1, Section 5, line (d), Column (3)), this section must be completed each year for ten (10) successive years.

This section of the computation schedule, as well as Section 5 of Part I, must be completed each year, for ten (10) years, and attached

to the annual tax return filed for each of the years.

The amount of credit computed annually in this section, plus the annual credit allowance computed on line 5 of Section 1, Part III, (if any),

is the amount of credit available each year.

Line 1. The amount of the qualified investment on this type of property was determined in Part 1. Enter the amount from Part I, Section

5, line (d), Column (3).

Line 2. Read the information and instructions for Part III, Section 1, line 2. Enter the applicable percentage.

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28