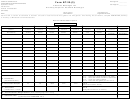

Line 13: Enter the totals from Schedule D for quantities

Specifi c Instructions - Front

shipped tax exempt to other distributors in Connecticut.

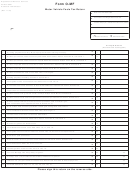

Line 1: Enter the sum of the amounts entered in Line 17 of

Columns A through H, on the back of the return.

Line 14: Enter the totals of Lines 11, 12, and 13 for each

column.

Line 2: Enter total amount of tax credit if any has been

authorized, for use on this return and attach the credit notice.

Line 15: Subtract Line 14 from Line 10.

Line 3: Subtract Line 2 from Line 1.

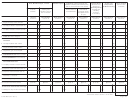

Line 16: The tax rate for Columns A through H applies to each

quantity converted to decimal system including the fractional

Line 4: The penalty for an incomplete return or late fi ling

part of each quantity. In computing quantity for each column it

is calculated at 10% (.10) of the amount of the tax due and

is mandatory that Column A contains barrels; Columns B, C,

unpaid or $50, whichever is greater. This penalty is in addition

D, E, F, and H contain wine gallons; and Column G contains

to any other penalty provided for in Chapter 220 of the general

proof gallons.

statutes.

Line 17: The tax amount for each column represents the

Line 5: Interest for late payment is calculated at 1% of the

result of the tax rate applied for each classifi cation of alcoholic

tax per month or fraction of the month from the due date to

beverage. Multiply Line 15 by Line 16 for each column.

the date of payment.

Line 6: Enter the sum of Lines 3, 4, and 5.

Line 7: Failure to respond Yes or No may be considered an

incomplete return. Pledged means the assignment of these

assets as security for loans negotiated.

0-255 Instructions (Rev. 06/11)

Page 4 of 4

1

1 2

2 3

3 4

4