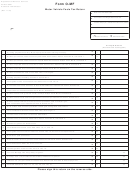

Beer, Malt Beverages, or Cider

Still Wines - Not more than 21%

Fortifi ed Wines

Distilled Liquors

Alcohol and

Liquor Coolers

alcohol.

(More than 21%

(Including cider containing more

Components

(Not more than

Alcohol) and

7% alcohol)

than 7% and not more than 21% alcohol)

for Manufacturing

Sparkling Wines

All other containers

Produced by

Convert

Produced by

(Including cider

(Including cider

small wineries

draft size

wineries which are

containing

containing not more

to barrels.

(Producing 55,000

not small wineries

more than

than 7% alcohol)

wine gallons or less

21% alcohol)

per year)

Barrels

Wine Gallons

Wine Gallons

Wine Gallons

Wine Gallons

Wine Gallons

Proof Gallons

Wine Gallons

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

00

00

00

00

00

00

00

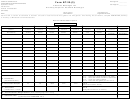

1. Physical inventory at start of month

00

00

00

00

00

00

00

00

2. Quantity purchased or acquired (Sch. A)

00

00

00

00

00

00

00

00

3. Tax-paid purchases and returns (Sch. B)

00

00

00

00

00

00

00

00

4. Produced by manufacturing process

00

00

00

00

00

00

00

00

5. Totals: Add Lines 1 through 4.

00

Deductions

00

00

00

00

00

00

00

6. Quantity emptied for Item 4 above

00

00

00

00

00

00

00

00

7. Physical inventory at end of month

00

00

00

00

00

00

00

00

8. Adjustments, gain, or loss: Explain.

00

9. Total deductions: Add Lines 6, 7, and 8.

00

00

00

00

00

00

00

00

10. Accountable Balance: Line 5 minus 9.

Non-Taxable Deductions

00

00

00

00

00

00

00

11. Tax-paid purchases and returns (Sch. B)

00

00

00

00

00

00

00

00

12. Shipments outside Connecticut (Sch. C)

00

00

00

00

00

00

00

00

13. Shipments within Connecticut (Sch. D)

00

14. Total non-tax deductions:

00

00

00

00

00

00

00

Add Lines 11, 12, and 13.

00

15. Taxable net quantity: Line 10 less Line 14.

00

00

00

00

00

00

00

00

@ $7.20

@ $0.24

@ $5.40

@ $0.72

@ $0.18

@ $1.80

@ $5.40

@ $2.46

16. Tax rate for each of the columns

Tax Amount for Each Alcoholic Beverage

17. Multiply Line 15 by Line 16 for each column.

00

00

00

00

00

00

00

00

Total Line 17, Columns A through H.

Transfer this amount to Line 1 on the front.

O-255 Back (Rev. 06/11)

Page 2 of 4

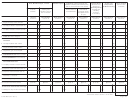

1

1 2

2 3

3 4

4