Form 706 (Rev. 11-01)

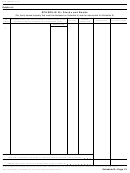

Examples of Listing of Property Interests on Schedule M

Item

Description of property interests passing to surviving spouse

Amount

number

1

One-half the value of a house and lot, 256 South West Street, held by decedent and surviving spouse as joint tenants

with right of survivorship under deed dated July 15, 1957 (Schedule E, Part I, item 1)

$132,500

2

Proceeds of Gibraltar Life Insurance Company policy No. 104729, payable in one sum to surviving spouse

(Schedule D, item 3)

200,000

3

Cash bequest under Paragraph Six of will

100,000

Instructions for Schedule

taker in default at the decedent’s

1. Another interest in the same

nonexercise of a power;

property passed from the decedent to

M—Bequests, etc., to

some other person for less than

4. As a beneficiary of insurance on the

Surviving Spouse (Marital

adequate and full consideration in

decedent’s life;

Deduction)

money or money’s worth; and

5. As the surviving spouse taking

2. By reason of its passing, the other

under dower or curtesy (or similar

General

person or that person’s heirs may enjoy

statutory interest); and

You must complete Schedule M and file

part of the property after the termination

6. As a transferee of a transfer made

it with the return if you claim a

of the surviving spouse’s interest.

by the decedent at any time.

deduction on item 20 of Part 5,

This rule applies even though the

Recapitulation.

Property Interests That You May

interest that passes from the decedent

The marital deduction is authorized by

Not List on Schedule M

to a person other than the surviving

section 2056 for certain property

spouse is not included in the gross

You should not list on Schedule M:

interests that pass from the decedent to

estate, and regardless of when the

1. The value of any property that does

the surviving spouse. You may claim the

interest passes. The rule also applies

not pass from the decedent to the

deduction only for property interests that

regardless of whether the surviving

surviving spouse;

are included in the decedent’s gross

spouse’s interest and the other person’s

estate (Schedules A through I ).

2. Property interests that are not

interest pass from the decedent at the

included in the decedent’s gross estate;

same time.

Note: The mar ital deduction is generally

not allowed if the surviving spouse is not

3. The full value of a property interest

Property interests that are considered

a U.S. citizen. The mar ital deduction is

for which a deduction was claimed on

to pass to a person other than the

allowed for property passing to such a

Schedules J through L. The value of the

surviving spouse are any property

surviving spouse in a “qualified domestic

property interest should be reduced by

interest that: (a) passes under a

trust” or if such property is transferred or

the deductions claimed with respect to

decedent’s will or intestacy; (b) was

irrevocably assigned to such a trust

it;

transferred by a decedent during life; or

before the estate tax retur n is filed. The

4. The full value of a property interest

(c) is held by or passed on to any

executor must elect qualified domestic

person as a decedent’s joint tenant, as

that passes to the surviving spouse

trust status on this retur n. See the

subject to a mortgage or other

appointee under a decedent’s exercise

instructions that follow, on pages 29–30,

of a power, as taker in default at a

encumbrance or an obligation of the

for details on the election.

decedent’s release or nonexercise of a

surviving spouse. Include on

Schedule M only the net value of the

power, or as a beneficiary of insurance

Property Interests That You May

on the decedent’s life.

interest after reducing it by the amount

List on Schedule M

of the mortgage or other debt;

For example, a decedent devised real

Generally, you may list on Schedule M

5. Nondeductible terminable interests

property to his wife for life, with

all property interests that pass from the

remainder to his children. The life

(described below);

decedent to the surviving spouse and

interest that passed to the wife does not

6. Any property interest disclaimed by

are included in the gross estate.

qualify for the marital deduction because

the surviving spouse.

However, you should not list any

it will terminate at her death and the

“Nondeductible terminable interests”

Terminable Interests

children will thereafter possess or enjoy

(described below) on Schedule M unless

the property.

Certain interests in property passing

you are making a QTIP election. The

from a decedent to a surviving spouse

However, if the decedent purchased a

property for which you make this

are referred to as terminable interests.

joint and survivor annuity for himself and

election must be included on

These are interests that will terminate or

his wife who survived him, the value of

Schedule M. See “Qualified terminable

fail after the passage of time, or on the

the survivor’s annuity, to the extent that

interest property” on the following page.

occurrence or nonoccurrence of some

it is included in the gross estate,

For the rules on common disaster and

contingency. Examples are: life estates,

qualifies for the marital deduction

survival for a limited period, see section

annuities, estates for terms of years,

because even though the interest will

2056(b)(3).

and patents.

terminate on the wife’s death, no one

You may list on Schedule M only

else will possess or enjoy any part of the

The ownership of a bond, note, or

those interests that the surviving spouse

property.

other contractual obligation, which when

takes:

discharged would not have the effect of

The marital deduction is not allowed

1. As the decedent’s legatee, devisee,

an annuity for life or for a term, is not

for an interest that the decedent

heir, or donee;

considered a terminable interest.

directed the executor or a trustee to

convert, after death, into a terminable

2. As the decedent’s surviving tenant

Nondeductible terminable interests.

interest for the surviving spouse. The

by the entirety or joint tenant;

A terminable interest is nondeductible,

marital deduction is not allowed for such

and should not be entered on

3. As an appointee under the

an interest even if there was no interest

Schedule M (unless you are making a

decedent’s exercise of a power or as a

QTIP election) if:

Page 28

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46