Form 706 (Rev. 11-01)

Estate of:

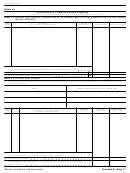

SCHEDULE U. Qualified Conservation Easement Exclusion

Part 1—Election

Note: The executor is deemed to have made the election under section 2031(c)(6) if he or she files Schedule U and excludes any

qualifying conservation easements from the gross estate.

Part 2—General Qualifications

1

Describe the land subject to the qualified conservation easement (see separate instructions)

2 Did the decedent or a member of the decedent’s family own the land described above during the 3-year

period ending on the date of the decedent’s death?

Yes

No

3

Describe the conservation easement with regard to which the exclusion is being claimed (see separate instructions).

Part 3—Computation of Exclusion

4

Estate tax value of the land subject to the qualified conservation easement (see separate

4

instructions)

5

Date of death value of any easements granted prior to decedent’s

5

death and included on line 10 below (see instructions)

6

6

Add lines 4 and 5

7

7

Value of retained development rights on the land (see instructions)

8

8

Subtract line 7 from line 6

9

9

Multiply line 8 by 30% (.30)

10

Value of qualified conservation easement for which the exclusion is

10

being claimed (see instructions)

Note: If line 10 is less than line 9, continue with line 11. If line 10 is

equal to or more than line 9, skip lines 11 through 13, enter “.40”

on line 14, and complete the schedule.

11

11

Divide line 10 by line 8. Figure to 3 decimal places (e.g., .123)

If line 11 is equal to or less than .100, stop here; the estate does

not qualify for the conservation easement exclusion.

12

Subtract line 11 from .300. Enter the answer in hundredths by rounding

any thousandths up to the next higher hundredth (i.e., .030 = .03; but

12

.031 = .04)

13

13

Multiply line 12 by 2

14

14

Subtract line 13 from .40

15

Deduction under section 2055(f) for the conservation easement (see

15

separate instructions)

16

16

Amount of indebtedness on the land (see separate instructions)

17

17

Total reductions in value (add lines 7, 15, and 16)

18

18

Net value of land (subtract line 17 from line 4)

19

19

Multiply line 18 by line 14

20

Enter the smaller of line 19 or the exclusion limitation (see instructions). Also enter this amount

20

on item 11, Part 5, Recapitulation, Page 3

Schedule U—Page 42

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46