Form 706 (Rev. 11-01)

4

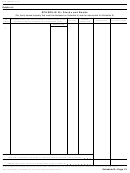

Personal property used in a qualified use and passing to qualified heirs.

B (continued)

A

B

A (continued)

Adjusted value (with

Adjusted value (with

Schedule and item

section 2032A(b)(3)(B)

Schedule and item

section 2032A(b)(3)(B)

number from Form 706

adjustment)

number from Form 706

adjustment)

“Subtotal” from Col. B, below left

Subtotal

Total adjusted value

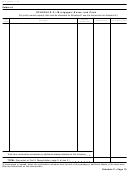

5

Enter the value of the total gross estate as adjusted under section 2032A(b)(3)(A).

6 Attach a description of the method used to determine the special value based on qualified use.

7

Did the decedent and/or a member of his or her family own all property listed on line 2 for at least 5 of the

8 years immediately preceding the date of the decedent’s death?

Yes

No

8

Were there any periods during the 8-year period preceding the date of the decedent’s death during which

Yes

No

the decedent or a member of his or her family:

a

Did not own the property listed on line 2 above?

b

Did not use the property listed on line 2 above in a qualified use?

c

Did not materially participate in the operation of the farm or other business within the meaning of section

2032A(e)(6)?

If “Yes” to any of the above, you must attach a statement listing the periods. If applicable, describe whether the exceptions of

sections 2032A(b)(4) or (5) are met.

9

Attach affidavits describing the activities constituting material participation and the identity and relationship to the

decedent of the material participants.

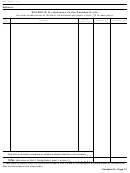

10

Persons holding interests. Enter the requested information for each party who received any interest in the specially valued property.

(Each of the qualified heirs receiving an interest in the property must sign the agreement, and the agreement must be filed

with this return.)

Name

Address

A

B

C

D

E

F

G

H

Identifying number

Relationship to decedent

Fair market value

Special use value

A

B

C

D

E

F

G

H

You must attach a computation of the GST tax savings attributable to direct skips for each person listed above who is a skip person. (See instructions.)

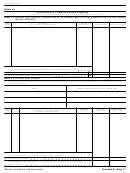

11

Woodlands election. Check here

if you wish to make a woodlands election as described in section 2032A(e)(13). Enter the

Schedule and item numbers from Form 706 of the property for which you are making this election

You must attach a statement explaining why you are entitled to make this election. The IRS may issue regulations that require more

information to substantiate this election. You will be notified by the IRS if you must supply further information.

Schedule A-1—Page 9

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46