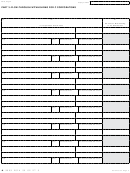

PART 4: FlOW-THROuGH WITHHOlDING FOR

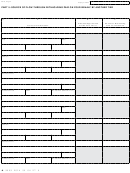

Mailing Addresses

NONRESIDENT INDIvIDuAlS

Mail the annual return and all necessary schedules to:

NOTE: A Form 4918 that is missing both Part 3 and Part 4 is

incomplete and unprocessable, and will be rejected. Include

With payment:

one, or the other, or both, as dictated by the nature of the

Michigan Department of Treasury

members.

PO Box 30806

Lansing MI 48909

Line 29A: Enter the name of each nonresident individual that

was withheld on during the filing period listed on this return.

Without payment:

Line 29B: Trusts are not required to be withheld on under

Michigan Department of Treasury

FTW. However, if a trust was withheld on, enter an “X” on this

PO Box 30805

line for each trust that was withheld on.

Lansing MI 48909

Line 29C: Enter the social security number of this nonresident

Make all checks payable to “State of Michigan.” Print

individual. If a trust was withheld on, enter the FEIN of the

taxpayer’s Federal Employer Identification Number (FEIN), the

trust.

tax year, and “FTW” on the front of the check. Do not staple

Line 29D: Enter on this line the distributive share of taxable

the check to the return.

income allocated to this nonresident individual, before

allocation and apportionment, during the filing period listed on

this return. The total amount of taxable income entered in this

column D must be equal to (or greater than, if line 26 is greater

than zero) the amount entered on line 9B.

Line 29E: Enter on this line the amount withheld and reported

to this nonresident individual. The total amount of withholding

entered in this column must be equal or greater than the

amount entered on line 16B.

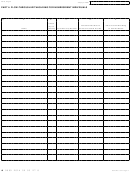

PART 5: SOuRCE OF FlOW-THROuGH

WITHHOlDING PAID ON yOuR BEHAlF By

ANOTHER TIER

Line 30A: Enter the name, FEIN, address, and tax year end

of each source flow-through entity that withheld on the flow-

through entity filing this return. If the flow-through entity

is unitary with the source flow-through entity and the CIT

taxpayer, enter those source flow-through entities first in this list.

If the flow-through entity withholds on an individual who will

report income using combined apportionment for unitary flow-

through entities, and the source flow-through entity is one of

those unitary entities, enter those source flow-through entities

first in this list.

NOTE: If the source entity’s address is outside the United

States, include the name of the country immediately after the

name of the city, separated by a comma, in the City field.

Line 30B: Enter on this line the allocated or apportioned

distributive share of income distributed by the source flow-

through entity to the filer and added to the withholding amount

to be distributed on line 11 of this return. The total amount

of allocated or apportioned distributive share income entered

in this column must be equal to or greater than the sum of

amounts entered on lines 11A and 11B. (See the instructions for

line 11A and line 11B.)

Line 30C: Enter on this line amounts withheld by the source

flow-through entity on behalf of the filer and entered on line 19

of this return. The total amount withheld on behalf of the filer

and entered in this column must equal the amount entered on

line 19 of this return.

21

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11