income using combined apportionment for unitary flow-

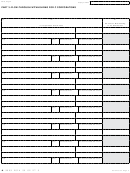

the right of the decimal point. Do not round percentages. For

through entities. For more information on withholding

example, 24.154266 percent becomes 24.1542 percent. When

for an individual who will report income using combined

converting a percentage to a decimal number, carry numbers

apportionment for unitary flow-through entities see the

out six digits to the right of the decimal point. For example,

instructions for Form 4919.

24.154266 percent becomes 0.241542. Do not enter a percent

symbol (%).

Due Dates of Annual Returns

The flow-through entity must only withhold on business

activity that is allocated or apportioned to Michigan. A flow-

The Flow-Through Withholding annual return is due on or

before the last day of the second month after the end of the

through entity that has not established nexus with one other

tax year. For example, a return for calendar year 2014 is due

state or a foreign country at the member level, as explained

February 28, 2015. A return for a fiscal year ending June 30,

below, is subject to Michigan FTW on its entire business

activity. If the flow-through entity is able to apportion its

2015 is due August 31, 2015.

business income, it will be apportioned to Michigan based

line-by-line Instructions

on sales. For a Michigan-based flow-through entity, all sales

are Michigan sales unless the flow-through entity’s business

Lines not listed are explained on the form.

activity causes its members to be subject to tax in another state

Line 1: If not a calendar-year flow-through entity, enter the

or foreign country.

beginning and ending dates (MM-DD-YYYY) that correspond

A flow-through entity will cause its C Corporation and

to the taxable period included in this return.

intermediate flow-through entity members to be subject to a

Tax year means the calendar year, or the fiscal year ending

tax at the member level in another state or foreign country if

the entity’s business activity is subject to a business privilege

during the calendar year, of which the withholding base of

a flow-through entity is computed. If a return is made for a

tax, a net income tax, a franchise tax measured by net income,

part of a year, tax year means the period for which the return

a franchise tax for the privilege of doing business, a corporate

is made. Generally, a flow-through entity’s tax year is for the

stock tax; or if the state or foreign country has jurisdiction to

same period as is covered by its federal income tax return. The

subject the flow-through entity’s business activity to one or

2013 form should be used for the 2013 calendar year or a fiscal

more of the above listed taxes at the member level, regardless

year ending in 2014.

of whether the tax is imposed.

Line 2: Enter the flow-through entity’s name.

A flow-through entity will cause its nonresident individual

Line 3: Enter the flow-through entity’s Federal Employer

members to be subject to a tax at the member level in another

Identification Number (FEIN). Be sure to use the same account

state or foreign country if the entity’s business activity is

subject to a net income tax, a franchise tax measured by net

number on all forms.

income, a franchise tax for the privilege of doing business,

NOTE: The flow-through entity must register for FTW before

or a corporate stock tax; or if that state or foreign country

filing this form. Flow-through entities are encouraged to

has jurisdiction to subject the flow-through entity’s business

register online at Flow-

activity to a net income tax at the member level, regardless of

through entities that register with the State online receive their

whether, in fact, the state does or does not so tax.

notification of the registration within seven days.

NOTE: If the flow-through entity does not have an FEIN, the

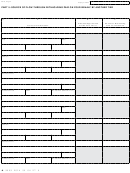

Line 5: When calculating the sales factor to use for members

that are C Corporations or intermediate flow-through entities,

flow-through entity must obtain an FEIN before filing. Visit

sale or sales means the amounts received by the flow-through

Treasury’s Business Taxes Web site for more information on

entity as consideration from the following:

obtaining an FEIN.

• The transfer of title to, or possession of, property that is

Returns received without a registered account number will

stock in trade or other property of a kind which would

not be processed until such time as a number is provided.

properly be included in the inventory of the flow-through

Line 4: Enter the flow-through entity’s complete address,

entity if on hand at the close of the tax period, or property

including the two-digit abbreviation for the country code. See

held by the flow-through entity primarily for sale to

the list of country codes in the Corporate Income Tax Forms

customers in the ordinary course of its trade or business.

and Instructions for Standard Taxpayers (Form 4890).

For intangible property, the amounts received will be

NOTE: Any refund and/or correspondence regarding the

limited to any gain received from the disposition of that

return filed and/or refund will be sent to the address listed here.

property.

The flow-through entity’s primary address in Treasury records,

• Performance of services which constitute business activities.

identified as the legal address and used for all purposes other

• The rental, leasing, licensing, or use of tangible or intangible

than refund and correspondence on a specific FTW return,

will not change unless the flow-through entity files a Notice of

property, including interest, that constitutes business

activity.

Change or Discontinuance (Form 163).

• Any combination of business activities described above.

PART 1: APPORTIONMENT PERCENTAGES

FOR INCOME FROM FlOW-THROuGH ENTITIES

• For flow-through entities not engaged in any other business

NOTE: Percentages should be carried out four digits to

activities, sales include interest, dividends, and other income

16

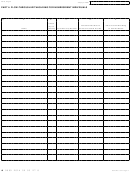

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11