Line 7 and the worksheet should account for total tentative

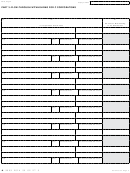

COluMN A

distributive income, including, where applicable, distributive

Business income means federal taxable income. For CIT purposes, federal

share income of a source entity that distributed withholding

taxable income means taxable income as defined in IRC § 63, except that federal

directly to the filer instead of the filer’s members on an

taxable income shall be calculated as if section 168(k) (bonus depreciation for

qualified property) and section 199 (qualified production activities deduction)

Annual Flow-Through Withholding Reconciliation Return

were not in effect. For a tax-exempt taxpayer, business income means only

(Form 4918).

that part of federal taxable income (as defined for CIT purposes) derived from

unrelated business activity.

NOTE: For a flow-through entity that had $200,000 or less in

COluMN B

annual business income after allocation or apportionment to

* Guaranteed payment as defined under the Internal Revenue Code of 1986

Michigan but withheld on members that are C corporations or

Section 707(c) is determined to be compensation for services rendered or

other flow-through entities, skip line 5 and Column A, lines 7

for the use of capital and is not considered to be a distributive share of the

partnership’s profits. The payment, to the extent included in federal adjusted

through 17 and enter the amount withheld on line 18. Complete

gross income, is characterized as compensation or interest on the individual’s

Form 4918 from this point. Also complete line 6 and Column B

return. A nonresident partner is taxed on a guaranteed payment to the extent the

where applicable.

payment is includable in federal adjusted gross income and is for compensation

received for personal services performed in this State. A guaranteed payment for

the use of capital is allocated to the nonresident partner’s state of domicile. For

Distributive Income Worksheet

nonresident individual members, no adjustments for “bonus depreciation” or the

Column A is the list of amounts that are added together to total tentative

domestic production activities deduction are required.

distributive income for C Corporation members that is reported on line 7A of

Form 4918. Column B is the list of amounts that are added together to total

Taxpayers and tax professionals are expected to be familiar

tentative distributive income for individual members that is reported on line

7B of Form 4918. If the flow-through entity is a partnership or an entity that

with uncommon situations within their experience, which

files federally as a partnership, this information can be found on U.S. Form

produce income not identified by specific lines on the

1065, Schedule K. If the flow-through entity is an S Corporation or an entity that

preceding worksheet, and report that amount on line 7A or 7B,

files federally as an S Corporation, these amounts can be found on U.S. Form

as applicable. Treasury may adjust the figure resulting from the

1120S, Schedule K. Enter in column A only the amounts that are attributable

to members that are intermediate flow-through entities that have been withheld

worksheet to account properly for such uncommon situations.

on or C Corporations (including C Corporations that have opted out of FTW)

Line 7A: Enter on this line the flow-through entity’s total

as reported on the Schedule K-1 that has been issued to each member. Do not

report amounts in column A if the flow-through entity had $200,000 or less in

tentative distributive income that is attributable to members

that are flow-through entities or C Corporations; including C

annual business income after allocation or apportionment to Michigan and did

not withhold on members that are C corporations or other flow-through entities.

Corporations that have opted out of FTW. Also include, where

Enter in Column B only the amounts that are attributable to members that are

applicable, distributive share income of a source entity that

individuals — this includes resident and nonresident individuals — as reported

distributed withholding directly to the filer instead of the filer’s

on the Schedule K-1 that has been issued to each member.

members.

A

B

Line 7B: Enter on this line the flow-through entity’s tentative

Tentative

Tentative

Distributive

Distributive

distributive income that is attributable to members that

Income for C

Income for

are individuals, including individuals that are residents of

Distributive Income Categories

Corporations

Individuals

Michigan. Also include, where applicable, distributive share

Ordinary income (loss) from trade or

business activity

income of a source entity that distributed withholding directly

Net income (loss) from rental real estate

to the filer.

activity

Net income (loss) from other rental

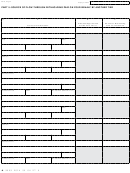

Line 8A: Enter as a positive number the sum of the following

activity

amounts:

Portfolio income (loss):

• Income received by the flow-through entity filing this

Interest income

form (intermediate) as a distributive share from another

flow-through entity (source) that is not unitary with the

Dividend income

intermediate and another C corporation member. In a

tiered structure, if the flow-through entity filing this form

Royalty income

(intermediate) earns income as a distributive share from

Net short-term capital gain (loss)

another flow-through entity (source) that is not unitary

Net long-term capital gain (loss)

with the intermediate and a C corporation member, that

XXXXXXXX

income will be apportioned according to the source entity’s

*

Guaranteed payments

sales factor. Thus, income received as a distributive share

from a source flow-through entity is subtracted prior to

Net gain (loss) under section 1231

apportionment of the filer’s own tentative distributive

Other income (loss)

income and added back to the total after the filer’s

TOTAl DISTRIBuTIvE INCOME

apportionment. This subtraction preserves the source

Add all amounts in Column A and carry

entity’s sales apportionment as applied to the distributive

to Form 4918, line 7A. Add all amounts

share income received by the filer from the source entity.

in Column B and carry to Form 4918,

line 7B.

Note that this subtraction applies only if the intermediate

flow-through entity is not unitary with the source and the C

corporation taxpayer, plus,

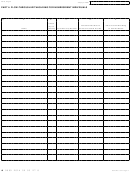

18

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11