Instructions for Form 4918

Annual Flow-Through Withholding Reconciliation Return

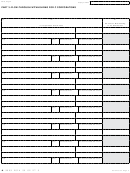

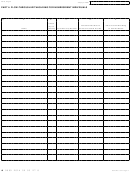

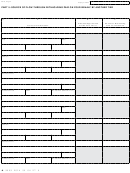

If more space is needed for Parts 3, 4 or 5, flow-through entities should go online to to

print out additional pages. Repeat the flow-through entity FEIN from page one at the top right of each additional page.

NOTE: A Form 4918 that is missing both Part 3 and Part 4 is incomplete and unprocessable, and will be rejected.

Include one, or the other, or both, as dictated by the nature of the members.

entity is required to use its best estimate of business income

Purpose

based on all available information. If, after this form is filed,

the flow-through entity determines that its best estimate of

This form is used to calculate the amount of Flow-Through

business income was incorrect, the flow-through entity should

Withholding (FTW) due for the tax year, reconcile this amount

with the quarterly payments remitted to the state, and to

report that difference to its members. The members, when

distribute the entire amount of FTW to the flow-through entity’s

filing their respective annual returns, will correct the over- or

members. This form should be used by any flow-through entity

under-withholding created by the over- or understatement of

that withholds amounts for purposes of the Individual Income

business income.

Tax (IIT) or Corporate Income Tax (CIT) for the tax year;

Parts 3 and 4 of this form distribute the FTW to the flow-

whether source or intermediate flow-through entity.

through entity’s members. Part 5 of this form records the FTW

NOTE: Under Public Act 233 of 2013, a flow-through entity

paid by source flow-through entities in a tiered structure that

that has made a valid election to file Michigan Business

distribute income and withholding to the flow-through entity

Tax (MBT) for the current tax year is not subject to flow-

filing this form.

through withholding with respect to its members that are C

When completing Parts 3 and 4, include only those members

Corporations.

that have been withheld on and only if the flow-through entity’s

tax year ends with or within the tax year of that member. When

General Instructions

completing Part 5, include only source flow-through entities

that withheld on the flow-through entity filing this form.

Trusts: For purposes of withholding, trusts are not considered

to be flow-through entities or members of flow-through entities.

Because of this, a trust is not required to be withheld on and is

Filing When unitary for CIT or IIT

not required to withhold on its beneficiaries. However, if FTW

For a flow-through entity that is unitary with a CIT

is done for a trust for the tax year, enter amounts in Column B,

taxpayer: If the flow-through entity filing this form is

“individuals.”

unitary with a CIT taxpayer, fill out the Schedule of Unitary

Exception: Grantor trusts that are disregarded entities for

Apportionment for Flow-Through Withholding (Form 4919),

tax purposes. The flow-through entity is required to withhold

and enter the amount from line 5 of Form 4919 on line 14A of

directly on the individual “grantor” if that individual is a

this form. Leave lines 5a, 5b, 5c, and 10A of this form blank.

nonresident individual.

For more information on what constitutes a unitary relationship

between a flow-through entity and a CIT taxpayer, see the

FTW on C Corporation and Intermediate Flow-Through

instructions for Form 4919.

Entity Members: If the allocated or apportioned business

income of the flow-through entity is $200,000 or less for

Flow-through Entities Withholding on an Individual Who

the flow-through entity’s tax year, FTW is not required on

Will Report Using Combined Apportionment for Unitary

members that are C Corporations or intermediate flow-

Flow-through Entities: An individual owner of flow-through

through entities. Further, if the flow-through entity received

entities may elect to apportion the business income of its flow-

an exemption certificate from a member for the tax year, FTW

through entities on a separate entity basis or a unitary basis if

is not required on that member. Complete this form to claim a

certain criteria are met. If the flow-through entity filing this

refund of the amounts paid on behalf of these members.

form withholds on an individual owner who will report income

For a flow-through entity that had $200,000 or less in

using combined apportionment for unitary flow-through

entities, the filer of this form will use a combined sales factor to

annual business income after allocation or apportionment

to Michigan, but withheld on members that are C

apportion the distributive share of business income attributable

Corporations or other flow-through entities: Skip line 5 and

to the individual member.

Column A, lines 7 through 17 and enter the amount withheld

A flow-through entity filing this form that withholds on

on line 18. Complete Form 4918 from this point. Also complete

an individual who will report income using combined

Line 6 and Column B where applicable.

apportionment for unitary flow-through entities, must fill out

This form may not be amended: When filing this form, the

Form 4919, using the instructions provided with that form.

flow-through entity is required to use its “tentative business

Enter the amount from line 5 of Form 4919, minus available

income” for the tax year. The Department recognizes that this

personal exemptions, on line 14B of this form. Leave lines

6a, 6b, 6c, and 10B and 12B of this form blank. The filer

amount potentially will not be known with certainty at the

time this form is filed. When filing this form, the flow-through

need only use this method when the individual will report

15

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11