• The property is shipped from an office, store, warehouse,

from investment assets and activities and from trading

assets and activities.

factory or other place of storage in Michigan and the

purchaser is the United States government or the taxpayer is

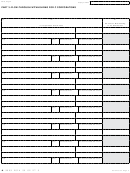

Use the information in the “Sourcing of Sales to Michigan”

not taxable in the state of the purchaser.

section in the Corporate Income Tax Forms and Instructions

for a Standard Taxpayer (Form 4890) to determine Michigan

Sales other than of tangible personal property are in Michigan

sales for members that are C Corporations or intermediate

if:

flow-through entities.

• The business activity is performed in Michigan, or

Entities unitary with one or more C corporation members:

• The business activity is performed both in Michigan and in

Leave lines 5a through 5c blank and continue to line 7.

another state(s), but based on cost of performance, a greater

Entities not unitary with one or more C Corporation

proportion of the business activity is performed in Michigan.

members: Complete line 5 using amounts for the flow-through

If the flow-through entity filing this form withholds on

entity’s business activity only.

a non-resident individual who will report income using

Line 5a: Enter the Michigan sales, as defined for members that

combined apportionment for unitary flow-through entities:

are C Corporations or intermediate flow-through entities, that

Leave lines 6a through 6c blank and continue to line 7.

are attributable to the flow-through entity.

Otherwise, complete line 6 using the sales that are attributable

to the flow-through entity.

Transportation services that source sales based on revenue

miles: Enter on this line the flow-through entity’s total sales,

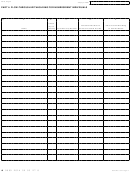

Line 6a: Enter the Michigan sales, as defined for members that

as defined for members that are C Corporations or intermediate

are individuals, that are attributable to the flow-through entity.

flow-through entities, multiplied by the ratio of Michigan

Include on this line any “throwback sales” of the flow-through

revenue miles over revenue miles everywhere as provided in

entity.

the “Sourcing of Sales to Michigan” chart in Form 4890 for

that type of transportation service. Revenue mile means the

Transportation services that source sales based on revenue

miles: Enter on this line the flow-through entity’s total sales,

transportation for consideration of one net ton in weight or one

as defined for members that are individuals, multiplied by

passenger the distance of one mile.

the ratio of Michigan revenue miles over revenue miles

NOTE: Only transportation services are sourced using revenue

everywhere as provided in the “Sourcing of Sales to

miles. To the extent the taxpayer has business activities or

Michigan” chart in Form 4890 for that type of transportation

revenue streams not from transportation services, those

service. Revenue mile means the transportation for

receipts should be apportioned accordingly.

consideration of one net ton in weight or one passenger the

Line 5b: Enter the total sales, as defined for members that are

distance of one mile.

C Corporations or intermediate flow-through entities, that are

Line 6b: Enter the total sales, as defined for members that are

attributable to the flow-through entity.

individuals, that are attributable to the flow-through entity.

Transportation services that source sales based on revenue

miles: Enter on this line the total sales, as defined for members

Transportation services that source sales based on revenue

miles: Enter on this line the total sales, as defined for members

that are C Corporations or intermediate flow-through entities,

that are individuals, that are directly attributable to the flow-

that are attributable to the flow-through entity.

through entity.

Line 6: When calculating the sales factor to use for members

that are individuals, sale or sales means all gross receipts of

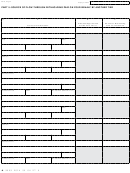

PART 2: TENTATIvE DISTRIBuTIvE INCOME

the taxpayer not allocated under the Individual Income Tax

Line 7: Because this reconciliation return is required to be

sections MCL 206.110 through MCL 206.114. Sale or sales

filed before the flow-through entity’s federal form, Treasury

includes gross receipts from sales of tangible property, rental

recognizes that this amount will be “tentative.” When

of property, and providing of services that constitute business

completing this form, use the best available information to

activity. Exclude all receipts from nonbusiness income.

come up with the most reasonable estimate for business income

NOTE: Throwback sales for individual income tax follow

at the time this form is filed. If it is later determined that the

federal P.L. 86-272 standards. The business must have physical

distributive income is different than what was reported on

presence in the other state or activity beyond solicitation of

line 7A or 7B, report this difference to the members that

sales of tangible personal property in order to exclude sales

have been withheld on. The members can then account for

into another state or country from the numerator. The Michigan

this change when filing the CIT Annual Return (Form 4891)

income tax act definition of “state” includes a foreign country.

if the member is a C Corporation, or the Michigan Individual

Therefore, foreign sales are considered Michigan sales unless

Income Tax Return (Form 1040) or Michigan Composite

the business entity is taxable in the foreign country.

Individual Income Tax Return (Form 807) if the member is an

individual. The flow-through entity is not permitted to amend

Sales of tangible personal property are in this state if:

this reconciliation return.

• The property is shipped or delivered to a purchaser (other

Use the following Tentative Distributive Income Worksheet

than the United States government) within Michigan

to calculate the flow-through entity’s tentative distributive

regardless of the free on board (F.O.B.) point or other

income. Retain a copy of this worksheet for your files.

conditions of the sale, or

17

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11