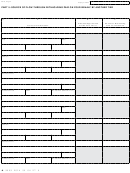

• The sum of the amounts listed in column C of the Flow-

through entities, enter as a positive number the amount of

personal exemption claimed on individuals. A flow-through

Through Withholding Opt-Out Schedule (Form 4920), if the

flow-through entity received an exemption certificate from

entity may deduct the same proportion of the total amount

one or more members. Include with this filing a completed

of personal and dependency exemptions that its nonresident

Form 4920. Retain the exemption certificates received by the

individual members would be entitled to deduct on a Michigan

flow-through entity for your records.

Individual Income Tax Return (MI-1040). Please note that these

• This entity’s allocable share of income from a source flow-

exemptions should only be taken one time throughout multiple

levels of income in a tiered structure situation.

through entity that has a valid election for the current year

to file Michigan Business Tax (MBT).

The amount of personal exemption available must be deducted

after allocation or apportionment. Therefore, if the flow-

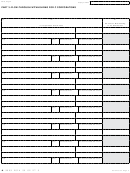

Line 8B: Enter as a positive number, the sum of the following:

through entity filing this form withholds on any individual

• The amount of the distributive share income reported on line

who will report income using combined apportionment

7B from the flow-through entity filing this return and from a

for unitary flow-through entities, leave line 12B blank. This

source flow-through entity that is allocated to members that

amount is calculated using the instructions to Form 4919. The

are both individuals and Michigan residents, plus,

result is then brought into Form 4918 on line 14B.

• Income received by the filer as a distributive share from

Line 13A: Add lines 10 and 11. This is total net distributive

a source flow-through entity to the extent that income is

income after apportionment but before application of the

allocated to nonresident individual members, unless the

unitary apportionment factor for flow-through entities that are

source flow-through entity will apply the same combined

unitary with the CIT taxpayer.

apportionment factor which will be used by the filer of this

Line 13B: Add lines 10 and 11 and subtract line 12. If less

form.

than zero, enter zero. This is total net distributive income after

Line 9: Subtract line 8A from line 7A and subtract line 8B

apportionment, less allowable personal exemptions.

from line 7B. This line represents the net distributive income

Line 14A: If the flow-through entity is unitary with the CIT

subject to withholding which will be apportioned using the

taxpayer, the flow-through entity must complete Form 4919.

filer’s apportionment factor.

Enter on this line the amount entered on line 5 of Form 4919

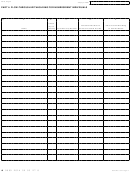

Line 10A: If unitary with a CIT taxpayer, leave line 10A blank.

plus any amount reported on line 11A of Form 4918. Include a

This amount is calculated on Form 4919 and brought into Form

completed Form 4919 with this Annual Reconciliation. If the

4918 on line 14.

flow-through entity is not unitary with a CIT taxpayer, leave

Line 10B: If the flow-through entity filing this form withholds

line 14A blank.

on an individual who will report income using combined

Line 14B: If the flow-through entity filing this form withholds

apportionment for unitary flow-through entities, leave line 10B

on an individual who will report income using combined

blank. This amount is calculated using Form 4919 and brought

apportionment for unitary flow-through entities, the flow-

into Form 4918 on line 14.

through entity must complete Form 4919. Enter on this line

Line 11A: Enter on this line, apportioned or allocated income

the amount entered on line 5 of Form 4919 plus any amount

received as a distributive share from a source flow-through

reported on line 11B of Form 4918 and minus the entire

entity, to the extent that the income was subtracted on

amount of personal exemption claimed on individuals. If the

flow-through entity must complete Form 4919, line 12B of the

line 8A. The amount entered on this line may not be greater

than the amounts entered in Part 5, line 30B, to the extent the

4918 must be blank. Include a completed Form 4919 with this

amounts entered there were withheld by a source on behalf of

Annual Reconciliation.

a C Corporation or other flow-through member of a the flow-

If the flow-through entity does not withhold on an individual

through entity filing this form.

who will report income using combined apportionment for

unitary flow-through entities, leave line 14B blank.

Line 11B: Enter on this line, to the extent that the income

was subtracted on line 8B, apportioned or allocated income

For a further explanation of what constitutes a unitary

received as a distributive share from a source flow-through

relationship, see the instructions to Form 4919.

entity to the extent the distributive share income is attributable

Line 16A: If the flow-through entity is not unitary with the CIT

to members that are non-resident individuals and the source

taxpayer, multiply line 15A by line 13A. If the flow-through

flow-through entity did not apply the same combined

apportionment factor as the filer of this form. This process of

entity is unitary with the CIT taxpayer, multiply line 15A by

line 14A. If less than zero, enter zero. The sum of all of the

subtraction and addition preserves the source entity’s sales

amounts entered on line 28B may be equal or greater (when line

apportionment factor as applied to the distributive share

income received by the filer from the source entity. The amount

26 is greater than zero) than the amount entered on this line.

entered on this line may not be greater than the amounts

Line 16B: If the flow-through entity does not withhold

entered in Part 5, line 30B, to the extent the amounts entered

on an individual who will report income using combined

there were withheld by a source on behalf of a non-resident

apportionment for unitary flow-through entities, multiply

individual member of a the flow-through entity filing this form.

line 15B by line 13B. If the flow-through entity withholds

Line 12B: If the flow-through entity filing this form does not

on an individual who will report income using combined

apportionment for unitary flow-through entities, multiply line

withhold on an individual who is an owner of unitary flow-

19

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11