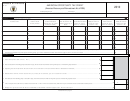

5. Annual New Jobs/Payroll Factor Computation

Number of Employees

Payroll of Employees

a. Pre-Credit Employment Levels:

New-Jobs Employed for Credit:

Total Employment in WV:

Total WV Payroll

b. Payroll Factor:

New Jobs Payroll

Payroll Factor

/

=

6. Annual Tax Offset Factor:

If Median compensation of new jobs is at least $37,701 (for 2012) then tax offset is 100%. Otherwise tax offset is

80%. Median compensation for this year is ______________________________. (See Administrative Notices for values

for other years.)

TAX CREDIT APPLICATION COMPUTATION

7. A. Tax Subject to Credit Offset

Tax Type

Pre-Credit Liability

X Payroll Factor

X Offset Factor

= Tax Subject to Credit Offset

B&O

X

X

=

BFT

X

X

=

CNIT

X

X

=

PIT*

X

X

=

TOTAL

X

X

=

B. Economic Opportunity Credit Applied

Tax Subject to Credit

Tax Credit

Tax Type

Pre-Credit Liability

Applied

Offset

After Credit Net Tax

B&O

BFT

CNIT

PIT*

TOTAL

* Individual Shareholders of S corporations and partnerships will also need to file a Personal Income Tax credit schedule.

8. Tax Credit Recap

a. Total credit pro-rated for this year

b. Unused credit carryover from last year

+

c. Total credit available this year

=

d. Total credit used this year (sum of “tax credit applied column of Section 7B)

e. Credit remaining for carryover to next year (subtract amount on line 8d from the

amount on line 8c, and enter here [if the next year is year 13, enter $0])

Under penalties of perjury, I declare that I have examined this credit claim form (including accompanying schedules and

statements) and to the best of my knowledge it is true and complete.

Signature of Taxpayer

Name of Taxpayer (type or print)

Title

Date

Telephone Number

Person to contact concerning this return

Signature of Preparer other than Taxpayer

Address

Date

Schedule EOTC-1 — Rev. 6-12

Page 2 of 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9