credit is claimed. In the third tax year the actual number

* Must work for at least 6 months at 20 or more hours per

of new jobs created must be certified by the business.

week to qualify

Adjustments must be made for the new jobs percentage if the

** These employees work at least 20 hours per week for at

number of new jobs certified varies from the number of new

least 6 months during the year

jobs estimated. The allowable credit is then redetermined for

*** Hours beyond 1,680 may not be counted as additional

prior and future years. Once certified, if the number of new

employees.

jobs declines in any tax year, resulting in a decreased new

jobs percentage, the credit is redetermined. However, if the

Required Employment Records

number of new jobs subsequently increases to the former

threshold, the credit will be reinstated.

The taxpayer must maintain records to establish the

following:

A qualified small business with no more than $7 million

in annualized sales must create at least ten (10) new

1. Total full-time equivalent employment in place

West Virginia jobs within twelve (12) months of placement

during the year immediately preceding the year

of qualified investment into service or use. If the number

qualified investment was first placed into service or

of new jobs declines in any subsequent year below the

use.

minimum of ten (10), then the credit is lost for that year.

2. Total full-time equivalent employment in place

However, if the number of new jobs subsequently increases

during each year of the project.

to the former threshold, the credit will be reinstated. If the

new number of new jobs rises to twenty (20) or more, then

Such records must be retained for a period of three (3) years

the new jobs percentage will increase to twenty percent

after the last year for which the credit is claimed.

(20%), and the general job calculation rules of the Economic

Qualified Investment Property

Opportunity Credit will apply.

A job is attributable to the qualified investment if:

Qualified investment property is property constructed,

purchased, leased or transferred into West Virginia and

1. The employee’s service is performed or his base of

placed in service or use, as a component of a new or

operations is at the new or expanded facility; and

expanded business facility located in this State. The amount

2. The position did not exist prior to the making of the

of the qualified investment is determined by the cost, or

investment in the new or expanded facility; and,

other basis, and the useful life of the property.

3. The position exists only because of the investment in

Critical elements in the determination of qualified

the new or expanded facility.

investment property for purposes of this credit are how, and

Calculation of Full-Time Equivalent Employees

from whom, the property is acquired; the acquisition date;

date and term of a lease; transfer date; date placed in service

The hours of qualified part-time employees are aggregated

or use in this State; as well as the useful life of the property.

to determine the number of equivalent full-time employees

For the Economic Opportunity Tax Credit, qualifying

for the purpose of determining the applicable new jobs

investment property acquired and placed in service or use in

percentage. However, they may not be aggregated for the

this State on or after January 1, 2003 may be counted toward

purpose of determining when a job is attributable to the

the credit.

qualified investment.

Qualified Investment Property May Include:

Part-time employment qualifies if the employee works at

least twenty (20) hours per week for at least six (6) months

1. Real property and improvements thereto, having a

or 520 hours per year (26 weeks @ 20 hours per week). Full-

useful life of four (4) or more years placed in service

time employment is 140 hours per month or 1,680 hours per

or use in West Virginia on or after January 1, 2003.

year (140 hours times 12 months). The following example

2. Real property and improvements thereto, or tangible

illustrates a calculation of full-time equivalent employees:

personal property acquired by written lease with

a primary term of ten (10) or more years placed in

Qualified Employees

Full-Time

Net Full-Time

service or use in West Virginia on or after January 1,

Equivalent

Equivalent

2003.

200 @ < 520 hrs

1,680

Do not Qualify*

3. Depreciable

or

amortizable

tangible

personal

50 @ 750 hrs

1,680**

= 22.32

property placed in service or use in West Virginia on

20 @ 1,500 hrs

1,680**

= 17.86

or after January 1, 2003 with a useful life of four (4)

6 @ 1,700 hrs

1,680***

= 6.00

or more years at the time the property is placed in

service or use in this State.

4 @ 2,080 hrs

1,680***

= 4.00

4. Tangible personal property acquired by written lease

Total Net Full-time Equivalent Employees = 50.18

having a primary term of four (4) or more years that

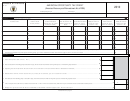

West Virginia Economic Opportunity Tax Credit Schedule EOTC-1 Page 2

West Virginia Economic Opportunity Tax Credit Schedule EOTC-1 Page 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9