taxpayer to utilize the full annual credit allowance

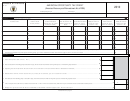

. Investment Years:

1

for that taxable year.

The

investment

window

for

the

Economic

3. Failure to maintain the number of jobs necessary to

Opportunity Tax Credit is normally one full year. However,

attain a jobs percentage in the 25% to 30% category:

the investment window for projects with a multiple year

The credit for year (s) affected must be redetermined

certification is up to three tax years. Enter the year(s) qualified

to reflect the jobs percentage attributable to the actual

investment is (was) placed into service. For example, if you

employment increase.

placed qualified investment into service during the 2003 tax

4. Credit attributable to property that ceases to be used

year, you would enter 1/2003-12/2003 in the space provided

in this State prior to the end of its categorized useful

for Year 1. If you contemplate a multiple year project

life must be recalculated for all tax years according to

certification and your first investment year occurred in 2003,

actual useful life. If the recalculation of credit according

you would possibly add information for Year 2 when you

to actual useful life results in an overutilization in a

complete this schedule for your 2004 tax return, and for Year

previous year, then a reconciliation statement must

3 when you complete this schedule for your 2005 tax return.

be filed with the payment of any additional tax and

Investment Summary [complete if you made

interest due. Credit attributable to property with a

2

qualified investment during the year]:

useful life of less than four (4) years is forfeited for

all years.

Enter the net costs of the property in Column (1) on the

appropriate line determined by the life of the property.

eXamPle

Then multiply the net costs in Column (1) by the applicable

percentages in Column (2). Enter the results in Column (3).

Company A creates 50 new jobs and invests $10 million in

Add the figures in Column (3) and enter on Line 4 of this

equipment with a designated useful life of eight (8) years

section. The amount on Line 4 represents the Taxpayer’s

in 2003. The credit for Company A is calculated to equal

qualified investment for this year.

$2,000,000 or $200,000 per year for ten (10) years. However,

Company A moves this equipment to New York in 2008;

Available Credit Calculation:

3

therefore the equipment’s actual useful life in West Virginia

is reduced to only five (5) years. The corresponding credit

Enter your qualified investment from Line 4 above

is reduced according to the above formula from $2,000,000

in Column (1). Enter the appropriate new jobs percentage

to $666,667 or $66,667 per year for ten (10) years. A

in Column (2). Then multiply the qualified investment

reconciliation statement for tax years 2003 through 2008

in Column (1) by the new jobs percentage in Column (2)

reflecting an overutilization of credit must be filed with

and enter the result in Column (3). The amount entered in

payment of any additional tax, interest, and penalties owed.

Column 3 represents your total available credit attributable

to this year’s qualified investment. This credit must be pro-

Redetermination is not Required:

rated for use over a ten-year period. Multiply the available

credit in Column (3) by 10% to arrive at the pro-rated

1. For a mere change in the form of conducting

available credit in Column (4).

business. However, the property must be retained in

a business in this State and the taxpayer must retain a

Pro-Rated Credit Allocation Summary:

4

controlling interest in the successor business .

This spreadsheet contains space for twelve rows

2. If the forfeiture occurs because property is stolen, or

of tax credit data. If the Taxpayer places investment into

damaged by fire, flood, storm, or other casualty.

service over a single tax year, the Taxpayer would have a

3. If the business is transferred or sold to a successor

pro-rated credit available over a 10-year period beginning

business in this State. According to laws governing

either with the year of investment or the following year per

the credit, any available credit allowed for is

election of the Taxpayer. If the Taxpayer places investment

subsequent tax years.

into service over a period of up to three tax years per certified

multiple year project, then the Taxpayer would have as

The Tax Credit Computation Schedule is designed to

many as three separate pro-rated credit streams beginning

accommodate all or any part of these tax credits. Contained

on up tothree separate years. For example, a Taxpayer with

within the schedule and instructions is more detailed

a multiple project certification has tax credits of $10 million,

information regarding the Economic Opportunity Tax

$5 million, and $2 million attributable to the 2003, 2004

Credits.

and 2005 tax years. This Taxpayer elects to begin claiming

each tax credit in the year investment was first placed into

I

s

eotc-1

nstructIons for

chedule

service. Therefore, the Taxpayer has a pro-rated $1 million

per year tax credit for the 2003-2012 period, a prorated $0.5

Complete business identification section, including business

million per year tax credit for the 2004-2013 period, and a

name, address, tax year, federal identification number and

pro-rated $0.2 million per year tax credit for the 2005-2014

North American Industry Classification System (NAICS)

period. An Economic Opportunity Tax Credit is available to

code.

West Virginia Economic Opportunity Tax Credit Schedule EOTC-1 Page 5

West Virginia Economic Opportunity Tax Credit Schedule EOTC-1 Page 5

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9