to exceed twenty (20) years or the remaining useful

The Applicable

life, whichever is less.

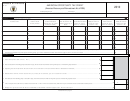

If Useful Life is:

Percentage is:

11. For leased property placed into service for which the

Less than 4 years

0 %

cost is not quantifiable at the outset of the lease, only

4 years or more but less than 6 years

33 ⅓ %

the quantifiable portion, if any, may be aggregated as

6 years or more but less than 8 years

66 ⅔ %

a qualified investment.

8 years or more

100 %

12. The cost of relocating corporate headquarters is

the expenses incurred and paid by the corporation

For example, if a Taxpayer purchases a machine for $25,000,

to unrelated third parties and which have been

for use in a new industrial facility, which has a useful life of

certified by the Tax Commissioner to have been both

six (6) years, the qualified investment is equal to $16,666.66.

reasonable and necessary to effectuate the move.

The $25,000 investment is multiplied by the applicable

useful life percentage of 66 2/3% to arrive at $16,666.66 in

Corporate Headquarters Relocation

qualified investment.

The Corporate Headquarters Relocation Credit is allowable

The credit can offset a portion of the tax attributable to

for corporate headquarters placed in service or use in

qualified investment for the Business and Occupation Tax

West Virginia on or after January 1, 2003. An out-of-state

[electric power generation taxes only], Business Franchise

corporation relocating its headquarters to West Virginia

Tax, Corporation Net Income Tax, and Personal Income Tax

is allowed a tax credit if it employs at lease fifteen (15)

[tax on flow through business profits only], in the order

domiciled West Virginia residents on a full-time basis at its

stated.

new location.

The Economic Opportunity Tax Credit is generally available

The adjusted qualified investment is the same as the qualified

for investment placed into service or use over a period of

investment determined for the Economic Opportunity Tax

365 days, beginning on the date when property purchased

Credit, plus the cost of reasonable and necessary expenses

or leased for business expansion is first placed into service

incurred to relocate the corporate headquarters.

or use. Provisions are available for multiple year projects as

long as project certification has been obtained from the Tax

The amount of the credit is determined by multiplying

Commissioner.

the adjusted qualified investment by 10 percent (10%).

However, if at least twenty (20) jobs are attributable to the

Redetermination, Forfeiture, and Recapture of

relocation or a combination of other qualified investment

Credit

and the relocation, the regular Economic Opportunity Tax

Credit percentages beginning at twenty percent (20%) may

If during any taxable year, property used as a qualified

be used.

investment for any of these credits is disposed of prior to

the end of its useful life or ceases to be used in an eligible

Calculation of Economic Opportunity Tax

business, the unused portion of the credit attributable to that

Credit

investment is forfeited for the taxable year and all ensuing

years. Forfeiture also applies if the taxpayer ceases operation

The credit is determined by multiplying the amount of the

of a business facility for which credit was allowed before

taxpayer’s qualified investment by the taxpayer’s new jobs

expiration of the useful life of the qualified investment

percentage and is generally applied over a ten (10) year

property. The failure to create or maintain the necessary

period (at 1/10th per year) beginning in the taxable year in

number of new jobs for credit entitlement also results in

which the qualified investment is placed in service or use,

credit forfeiture.

or, at the taxpayer’s option, in the next succeeding tax year.

For example, a Credit of $200,000 attributable to $1 million

Redetermination, Forfeiture, and Recapture of

of qualified investment made in 2003 is applied at a rate of

Credit

$20,000 per year for the 2003-2012 period, or alternatively, at

a rate of $20,000 per year for the 2004-2013 period.

1. Failure to create the minimum number of new jobs

within the required two to three year period: The

This calculation of qualified investment is determined by

entire credit is forfeited. Any Credit claimed during

multiplying the net cost of eligible property by its applicable

the first three (3) years must be paid back (recaptured)

useful life percentage based on the projected actual economic

with interest and a ten (10%) percent penalty.

useful life of the asset. The following percentages apply:

2. Failure to maintain the minimum number of new

jobs in any year subsequent to the initial three-year

(3) period (i.e. years four (4) through ten (10)): The

credit is forfeited for any year in question, but may

be reinstated for any remaining year in which the

minimum number is attained, thus enabling the

West Virginia Economic Opportunity Tax Credit Schedule EOTC-1 Page 4

West Virginia Economic Opportunity Tax Credit Schedule EOTC-1 Page 4

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9