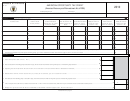

Tax Subject To Credit Offset [Column 2] – Wherever

Tax Credit Recap:

8

applicable, copy the amount from Section 7A, Column 4.

a. Total Credit Pro-Rated For This Year – Enter the

Tax Credit Applied [Column 3] – Use the total credit

amount of credit available for this tax year from Section 4,

available for this year from Section 4, Column 5 plus any

Column 5.

credit carryover from prior years [Section 8, Line 5 from last

b. Unused Credit Carryover from Last Year: - Enter the

year’s WV/EOTC-1] to offset up to 100% of the amount of

amount of any credit carried over from last year [the amount

Tax Subject To Credit Offset in Column 2 for each applicable

from Section 8, Line 5 from last year’s WV/EOTC-1].

tax starting with the Business and Occupation Tax [B&O] or

Business Franchise Tax [BFT]. The credit claimed may never

c. Total Credit Available This Year – Sum the amounts from

exceed the value of Tax Subject To Credit Offset in Column

Line 1 and Line 2. This amount represents the total available

2.

credit for use this year.

After Credit Net Tax [Column 4] – Subtract the amount of

d. Total Credit Used This Year – Enter the sum of Tax Credit

Tax Credit Applied in Column 3 from the amount of Pre-

Applied this year [the sum total of Section 7B, Column 3].

Credit Liability in Column 1. This represents the net amount

of tax due after application of the Economic Opportunity

e. Credit Remaining for Carryover to Next Year – Subtract

Tax Credit.

the amount of Total Credit Used This Year on Line 4 from

the amount of Total Credit Available This Year on Line 3.

This amount is available for carryover to next year, unless

next year represents the 13th Tax Year following the first

year of credit use. Any Economic Opportunity Tax Credit

remaining after 13 years of use is forfeited.

West Virginia Economic Opportunity Tax Credit Schedule EOTC-1 Page 7

West Virginia Economic Opportunity Tax Credit Schedule EOTC-1 Page 7

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9