this Taxpayer for a period covering 12 years.

Column 2- Enter the amount of total payroll from all jobs

here [i.e., the amount in 5a). Column 2, Line 3].

Column 1 [Year Available] – Enter the tax years for which

a pro-rated credit is available for use (e.g., 2003 in the first

Column 3- Divide the amount in Column 1 by the amount in

row, followed by 2004 in the second row, and continuing

Column 2 and enter the result rounded to six decimals here.

until 2012 in the tenth row). If your investment occurred in

Annual Tax Offset Factor:

2003, then your first year should either be 2003 or 2004 [if

6

you elected to defer the beginning year of credit on your

The annual tax credit offset factor for 2012 depends

Application Form EOTC-A].

upon the median salary attributable to the new jobs in 2012.

If the median salary is at least $37,701, your tax offset factor

Column 2 [Year 1] – Enter the amount of pro-rated tax credit

is one hundred percent [100%] in 2012. Otherwise, your tax-

available in each year over the 10-year period.

offset factor is 80% in 2003. Enter the median compensation

Column 3 [Year 2] – If applicable and when applicable, enter

paid this year to your new employees. For example, if you

the amount of pro-rated tax credit available in each year for

have 51 new jobs and you sort these jobs from highest paid

your actual investment during the second year of a multiple

to lowest paid, the salary paid to the 26th employee in this

year project, beginning on the row that corresponds with the

sort represents the median salary paid for this year. [See

year of such investment, or the following year if so elected

Administrative Notices for values for other years.]

by the Taxpayer. Column 4 [Year 3] – If applicable and

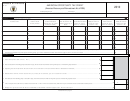

t

c

a

c

aX

redIt

PPlIcatIon

omPutatIon

when applicable, enter the amount of pro-rated tax credit

available in each year for your actual investment during the

Tax Subject to Credit Offset:

third year of a multiple year project, beginning on the row

7A

that corresponds with the year of such investment, or the

Pre-Credit Liability [Column 1] – Wherever

following year if so elected by the Taxpayer.

applicable, enter your adjusted pre-credit West Virginia State

tax liability for State Business and Occupation Tax [B&O],

Column 5 [Total Credit] – Sum up the total available tax

Business Franchise Tax [BFT], Corporation Net Income Tax

credit for each applicable year (i.e., the amount in Column 2,

[CNIT] and Personal Income Tax [PIT].

Column 3, and Column 4). This represents the total available

Economic Opportunity Tax Credit available for tax liability

Total these liabilities on the last line. The adjusted pre-credit

reduction in each year, absent carryovers.

Business Franchise Tax liability is tax liability remaining after

first subtraction of the amount of any Subsidiary Credit or

Annual New Jobs/Payroll Factor Computation:

5

Business and Occupation Tax Credit claimed. The adjusted

a). Pre-Credit Employment Levels:

pre-credit Personal Income Tax liability is tax liability

directly attributable to the pass-through business profits

Column 1, Line 1-Enter the number of full-time equivalent

of the business entity qualified to receive the Economic

employees employed by you and other members of your

Opportunity Tax Credit.

controlled group within West Virginia during the twelve-

month period prior to the first placement of qualified

Payroll Factor [Column 2] – On each applicable row, enter

investment attributable to an Economic Opportunity Tax

the payroll factor from Section 5 b.) Column 3. This factor

Credit into service or use.

should roughly represent the portion of tax liability directly

attributable to qualified investment. If this project involves

Column 2, Line 1-Enter the total dollar amount of the annual

the relocation of a corporate headquarters, the payroll factor

payroll associated with these employees for this year.

only applies to tax attributable to apportioned business

income, and 100% of the tax attributable to allocated non-

Column 1, Line 2- Enter the number of full-time equivalent

business income may also be offset by the tax credit.

new jobs created as the result of your qualified investment.

Offset Factor [Column 3] – On each applicable row, enter the

Column 2, Line 2- Enter the total dollar amount of the annual

offset factor from Section 6. This offset factor will either be

payroll associated with these new jobs for this year.

80% or 100% depending upon median compensation.

Column 1, Line 3- Enter the total number of full-time

Tax Subject To Credit Offset [Column 4] – On each applicable

equivalent employees employed by you and other members

row, multiply the Pre-Credit Liability amount in Column 1

of your controlled group within West Virginia for this year.

by both the Payroll Factor in Column 2 and the Offset Factor

in Column 3 to arrive at the Tax Subject To Credit Offset in

Column 2, Line 3- Enter the total dollar amount of the annual

Column 4.

payroll associated with all employees for this year.

Economic Opportunity Tax Credit Applied:

b). Payroll Factor:

7B

Pre-Credit Liability [Column 1] – Wherever

Column 1- Enter the amount of new jobs payroll here [i.e.,

applicable, copy the amount from Section 7A, Column 1.

the amount in 5a). Column 2, Line 2].

West Virginia Economic Opportunity Tax Credit Schedule EOTC-1 Page 6

West Virginia Economic Opportunity Tax Credit Schedule EOTC-1 Page 6

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9