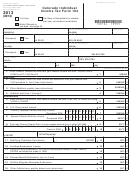

*130104PN29999*

Federal

Colorado

Information

Information

17. Enter income from line 16 that was earned from Colorado sources; and/or rent and royalty income

received or credited to your account during the part of the year you were a Colorado resident; and/or

partnership/S corporation/fiduciary income that is taxable to Colorado during the tax year

987

17

00

987

18. Enter all other income from form 1040 lines 10, 11 and 21

18

00

List type

987

19. Enter income from line 18 that was earned during that part of the year you were a Colorado resident

and/or was earned from a Colorado operation

19

987

00

List type

987

20. Total Income. Enter amount from form 1040 line 22; or form 1040A line 15

20

987

00

21. Total Colorado Income. Enter the total from the Colorado column, lines 5, 7, 9, 11, 13, 15, 17 and 19

21

987

00

22. Enter all federal adjustments from form 1040 line 36, or form 1040A line 20

987

22

00

List type

987

23. Enter adjustments from line 22 as follows

23

987

00

List type

hkhkjhkhkjh

• Educator expenses, IRA deduction, business expenses of reservists, performing artists and fee-basis government

officials, health savings account deduction, self-employment tax, self-employed health insurance deduction, SEP

and SIMPLE deductions are allowed in the ratio of Colorado wages and/or self-employment income to total wages

and/or self-employment income.

• Student loan interest deduction, alimony, and tuition and fees deduction are allowed

in the Colorado to federal total income ratio (line 21/ line 20).

• Domestic production activities deduction is allowed in the Colorado to Federal QPAI ratio.

• Penalty paid on early withdrawals made while a Colorado resident.

• Moving expenses if you are moving into Colorado, not if you are moving out.

• For treatment of other adjustments reported on form 1040 line 36, see FYI Income 6.

24. Adjusted Gross Income. Enter amount from form 1040 line 37; or form 1040A line

898798

21; or form 1040EZ line 4

24

00

25. Colorado Adjusted Gross Income. If you filed form 1040 or 1040A, subtract the amount on line 23 of

Form 104PN from the amount on line 21 of Form 104PN. If you filed form 1040EZ, enter the total of

lines 5, 7 and 9 of Form 104PN

25

987

00

26. Additions to Adjusted Gross Income. Enter the amount from line 3 of Colorado

Form 104 excluding any charitable contribution adjustments

26

00

7

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28