Page 6

Due Date

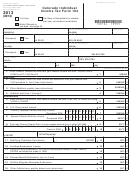

How To Use This Filing Guide

Form 104 and any tax payment owed are due April 15,

This filing guide will assist you with completing your Colorado

2014. Revenue Online will accept returns as timely filed

Income Tax Return. Once you finish the form, file it with a

until midnight. Returns that are mailed must be postmarked

computer, smartphone, or tablet using our free and secure

by April 15th. An automatic extension to file is granted until

Revenue Online service at

October 15th, but there is no extension to pay. See 25 for

Or, you may file using private e-file software or with a tax

more information.

preparer. By filing your return electronically, you significantly

reduce the chance of errors and you will receive your refund

Deceased Persons

much faster. If you cannot file electronically for any reason,

Legal representatives and surviving spouses may file a

mail the enclosed forms as instructed.

return on behalf of a deceased person. Surviving spouses

Please read through this guide before starting your return.

may complete the return as usual and indicate the

deceased status on the return. They can file the return and

The following symbols appear throughout this guide and point

submit a copy of the death certificate through Revenue

out important information, reminders, and changes to tax rules.

Online. Legal representatives may file the return and

This points out a topic that is the source of

submit a copy of the death certificate through Revenue

common filing errors. Filing your return on

Online, but they must complete the Third Party Designee

Revenue Online will limit errors somewhat;

portion of the return. Either a surviving spouse or legal

however, it is important to understand the

representative can avoid problems when filing on paper

information on your return. Errors cause

by marking the box next to the name of the deceased

processing delays and erroneous bills.

person; writing “DECEASED” in large letters in the white

space above the tax year of the return; writing “FILING AS

Several subtractions and tax credits require you to

SURVIVING SPOUSE” or “FILING AS LEGAL REPRE-

provide supporting documentation. This symbol points

SENTATIVE” after their signature; and attaching the DR

out those requirements. If the additional documentation

0102 and a copy of the death certificate to the return.

is not provided, it will cause processing delays

or denial of the credits/subtractions. These

To claim a refund on behalf a deceased person,

documents can be scanned and attached to your

complete form DR 0102 and submit it, as well as a

Revenue Online or electronic filing, mailed with the DR

copy of the death certificate, when filing the return.

1778, or attached to your paper return.

Filing Status

In-depth tax information is available in our easy

You must file using the same filing status on both

to understand FYI Publications, which include

examples and worksheets. This symbol lets you

your federal and Colorado income tax returns.

Parties to a Civil Union should refer to federal

know when such a publication is available for a

subject. All FYI publications are available at

tax law to determine the correct filing status. For

Married Filing Joint, you must list the taxpayer

names in the same order on both the federal and

Filing Information

Colorado returns. For married filing separate, do

not list your spouse’s name or SSN on the return.

Who Must File This Tax Return

Each year you must evaluate if you should file a Colorado

Line by Line Instructions

income tax return. Generally, you must file this return if you were:

First, complete the federal income tax return you will file

• A full-year resident of Colorado; or

with the IRS. You must complete your federal return first

because you will use information from that return on your

• A part-year Colorado resident who receives

Colorado income tax return.

taxable income while residing here; or

Colorado income tax is based on your federal taxable

• Not a resident of Colorado, but receives income

income, which has already considered your exemptions

from sources within Colorado;

and deductions.

and

Residency Status

• Are required to file a federal income tax return

Mark the appropriate box to designate your residency

with the IRS for this year; or

status. If Married Filing Joint, and one person is a full-year

• Will have a Colorado income tax liability for this year.

Colorado resident and the other is either a part-year

Colorado residents must file this return if they file

resident or a nonresident, mark the Part-Year Resident/

an income tax return with the IRS, even if they

Nonresident box.

do not have a Colorado tax liability. Otherwise,

Part-Year Colorado Residents and

the Department may file a return on your behalf

and our return might not consider your unique tax

Nonresidents

situation. Also, the only way to determine if you are

Tax is prorated so that it is calculated only on income

entitled to a refund is to file a return.

received in Colorado or from sources within Colorado.

We recommend you review publication FYI Income 6 if

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28