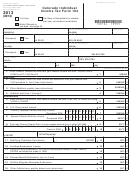

FORM 104 (10/08/13)

*130104==29999*

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0005

7987

17. Subtotal, add lines 5 through 16

17

0 0

987

18. Colorado Taxable Income, line 4 minus line 17

18

0 0

Tax, Prepayments and Credits: full-year residents turn to page 21 and p art-year and nonresidents go to 104PN

19. Colorado Tax from tax table or 104PN line 36

19

987

0 0

987

20. Alternative Minimum Tax from Form 104AMT

20

0 0

21. Recapture of prior year credits

21

987

0 0

22. Subtotal, add lines 19 through 21

22

987

0 0

23. Nonrefundable Credits from 104CR line 39, cannot exceed the

987

sum of lines 19 and 20

23

0 0

24. Total Enterprise Zone credits used – as calculated, or form DR 1366 line 70

24

9879

0 0

25. Net Tax, subtract lines 23 and 24 from line 22

25

879

0 0

26. CO Income Tax Withheld from W-2s and 1099s.

Staple W-2s and 1099s

here. Use only for line 26.

Staple only if line 26 is greater than $0

26

0 0

879

27. Prior-year Estimated Tax Carryforward

27

87

0 0

28. Estimated Tax Payments, enter the sum of the quarterly payments

987

remitted for this tax year

28

0 0

29. Extension Payment remitted with form 158-I

29

987

0 0

30. Other Prepayments:

104BEP

DR 0108

DR 1079

987

30

0 0

31. Innovative Motor Vehicle Credit from line 36 form DR 0617

31

987

0 0

987

32. Refundable Credits from 104CR line 9

32

0 0

33. Subtotal, add lines 26 through 32

33

9879

0 0

34. Federal Adjusted Gross Income from your federal income tax form: 1040EZ line 4;

87

1040A line 21; 1040 line 37

34

0 0

35. Overpayment, if line 33 is greater than 25 then subtract line 25 from line 33

35

987

0 0

36. Estimated Tax Credit Carry Forward to 2014 first quarter, if any

987

36

0 0

Voluntary Contributions enter your donation amount, if any

37. Nongame and Endangered Wildlife Cash Fund

37

987

0 0

38. Colorado Domestic Abuse Program Fund

38

0 0

987

39. Homeless Prevention Activities Program Fund

39

0 0

9879

40. Western Slope Military Veterans Cemetery Fund

40

0 0

87

41. Pet Overpopulation Fund

41

987

0 0

42. Colorado Healthy Rivers Fund

42

987

0 0

987

43. Alzheimer’s Association Fund

43

0 0

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28