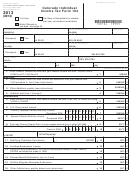

*130104PN39999*

Federal

Colorado

Information

Information

27. Additions to Colorado Adjusted Gross Income. Enter any amount from line 26 that is from non-Col-

orado state or local bond interest earned while a Colorado resident, and/or any lump-sum distribu-

tion from a pension or profit sharing plan received while a Colorado resident. (See FYI Income 6 for

treatment of other additions)

27

987

00

987

28. Total of lines 24 and 26

28

00

29. Total of lines 25 and 27

29

00

987

30. Subtractions from Adjusted Gross Income. Enter the amount from line 17 of

Colorado Form 104 excluding any qualifying charitable contributions

30

987

00

31. Subtractions from Colorado Adjusted Gross Income. Enter any amount from line 30

987

as follows:

31

00

• The state income tax refund subtraction to the extent included on line 19 above,

• The federal interest subtraction to the extent included on line 7 above,

• The pension/annuity subtraction and the PERA or DPS retirement subtraction to the extent included on line 13 above,

• The Colorado capital gain subtraction to the extent included on line 11 above,

• For treatment of other subtractions, see FYI Income 6.

32. Modified Adjusted Gross Income. Subtract the amount on line 30 from the amount

on line 28

32

987

00

33. Modified Colorado Adjusted Gross Income. Subtract the amount on line 31 from the

amount on line 29

33

987

00

%

34. Amount on line 33 divided by the amount on line 32

34

987

987

35. Tax from the tax table based on income reported on Colorado Form 104 line 18

35

00

36. Apportioned tax. Amount on line 35 multiplied by the percentage on line 34. Enter

here and on Form 104 line 19

36

987

0 0

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28