Print your LA Revenue Account Number here.

_____________________________

u

All applicable schedules must be completed.

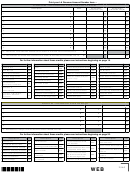

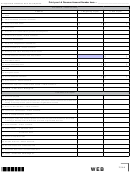

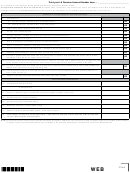

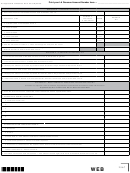

Schedule A – Balance Sheet

ASSETS

1. Beginning of year

2. End of year

1. Cash

2. Trade notes and accounts receivable

(

)

(

)

3. Reserve for bad debts

4. Inventories

5. Investment in United States government obligations

6. Other current assets – Attach schedule.

7. Loans to stockholders

8. Stock and obligations of subsidiaries

9. Other investments – Attach schedule.

10. Buildings and other fixed depreciable assets

(

)

(

)

11. Accumulated amortization and depreciation

12. Depletable assets

(

)

(

)

13. Accumulated depletion

14. Land

15. Intangible assets

(

)

(

)

16. Accumulated amortization

17. Other assets – Attach schedule.

18. Excessive reserves or undervalued assets – Attach schedule.

19. Totals – Add Lines 1 through 18.

Liabilities and Capital

20. Accounts payable

21. Mortgages, notes, and bonds payable one year old or less at balance sheet date and

having a maturity of one year or less from original date incurred

22. Other current liabilities – Attach schedule.

23. Loans from stockholders – Attach schedule.

24. Due to subsidiaries and affiliates

25. Mortgages, notes, and bonds payable more than one year old at balance sheet date

or having a maturity of more than one year from original date incurred

26. Other liabilities – Attach schedule.

27. Capital stock:

a. Preferred stock

b. Common stock

28. Paid-in or capital surplus

29. Surplus reserves – Attach schedule.

30. Earned surplus and undivided profits

31. Excessive reserves or undervalued assets

32. Totals – Add Lines 20 through 31.

WEB

2564

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10