Print your LA Revenue Account Number here.

_____________________________

u

All applicable schedules must be completed.

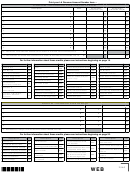

Schedule E – Calculation of Income Tax

1. Print the amount of net taxable income from CIFT-620, Line 1F.

Column 1

Column 2

RATE

2. Calculation of tax

Net income

TAX

in each bracket

a. First $25,000 of net taxable income

x 4% =

b. Next $25,000

x 5% =

c. Next $50,000

x 6% =

d. Next $100,000

x 7% =

e. Over $200,000

x 8% =

3. Add the amounts in Column 1, Lines 2a through 2e and print the result.

4. Add the amounts in Column 2, Lines 2a through 2e. Round to the nearest dollar. Print the

result in Column 2 and on CIFT-620, Line 2.

Schedule F – Calculation of Franchise Tax

1. Print the amount from CIFT-620, Line 7C or Line 8, whichever is greater.

2. Print the amount of Line 1 or $300,000, whichever is less.

3. Multiply the amount on Line 2 by $1.50 for each $1,000 or major fraction and print the result.

4. Subtract Line 2 from Line 1 and print the result.

5. Multiply the amount on Line 4 by $3.00 for each $1,000 or major fraction and print the result.

6. Add Lines 3 and 5. Round to the nearest dollar. Print the result here and on CIFT-620, Line 9.

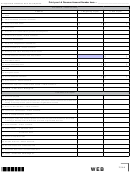

Schedule G – Reconciliation of Federal and Louisiana Net Income

Schedule G is required if Form CIFT-620A, Apportionment and Allocation Schedules are filed with this return.

Important! See R.S. 47:287.71 and R.S. 47:287.73 for information.

1. Print the total net income calculated under federal law before special deductions.

2. Additions to federal net income:

a. Louisiana income tax

b.

c.

d.

e.

f.

Subtractions from federal net income:

a. Dividends

b. Interest

c. Road Home – The amount included in federal taxable income

d. Louisiana depletion in excess of federal depletion

e. Expenses not deducted on the federal return due to Internal Revenue Code Section 280C

f. Other subtractions – Attach schedule.

3. Louisiana net income from all sources – The amount should agree with Form CIFT-620A, Schedule P, Line 26.

2567

WEB

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10