Print your LA Revenue Account Number here.

_____________________________

u

All applicable schedules must be completed.

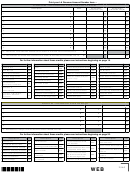

Schedule h – Reconciliation of Income Per Books with Income Per Return

1. Net income per books

7. Income recorded on books this year, but not

included in this return – Itemize.

2. Louisiana income tax

3. Excess of capital loss over capital gains

4. Taxable income not recorded on books this

year – Itemize.

8. Deductions in this tax return not charged

against book income this year:

a. Depreciation

b. Depletion

c. Other

5. Expenses recorded on books this year, but not

deducted in this return:

a. Depreciation

b. Depletion

c. Other

9. Total – Add Lines 7 and 8.

10. Net income from all sources per return –

Subtract Line 9 from Line 6.

6. Total – Add Lines 1 through 5.

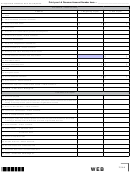

Schedule I – Summary of Estimated Tax Payments

Check number

Date

Amount

1. Credit from prior year return

2. First quarter estimated payment

3. Second quarter estimated payment

4. Third quarter estimated payment

5. Fourth quarter estimated payment

6. Payment made with extension request

7. Total – Add Lines 1 through 6.

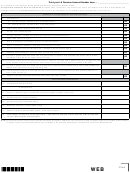

Additional Information Required

1. Indicate principal place of business. ___________________________

5. At the end of the tax year, did you directly or indirectly own 50% or more

of the voting stock of any corporation or an interest of any partnership,

2. Describe the nature of your business activity and specify your principal

product or service, both in Louisiana and elsewhere.

including any entity treated as a corporation or partnership?

o

o

Yes

No

Louisiana:

If “yes,” show name, address, and percentage owned.

Elsewhere:

6. At the end of the tax year, did any corporation, individual, partnership,

trust, or association directly or indirectly own 50% or more of your voting

3. Indicate the date and state of incorporation. _____________________

o

o

stock?

Yes

No

4. Indicate parishes in which property is located.

If “yes,” show name, address, and percentage owned.

WEB

2568

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10