Form Rev-415 As - Employer Withholding Information Guide Page 10

ADVERTISEMENT

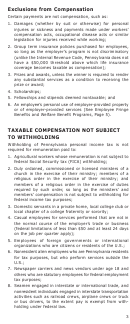

5. Expenses for travel, meals and lodging on business trips;

transportation expenses (but not commuting); and business

expenses incurred by outside salesmen.

6. Office or work area expenses if:

a. The duties of employment require a suitable work

area;

b. A suitable work area is not provided by the employer;

c. The work area used constitutes a principal place of

work; and

d. The work area is used regularly and exclusively to

perform the duties of employment.

7. Expenses paid or incurred by an employee for moving

him/herself, the immediate family, household goods and

personal effects, provided the transfer is in the interest

of and benefits the present employer, and is from one

permanent duty station to another.

8. Education expenses only if:

a. The education specifically is required by law or by the

employer to retain an established employment status

or rate of compensation; and

b. The education is not part of a program for a new occu-

pation, trade or business, even if the employee does

not intend to enter that new occupation, trade or busi-

ness. Education costs voluntarily paid or incurred

merely to maintain or improve skills are not allowable

business expenses.

9. Business gifts.

COLLECTION OF TAXES

Tax is to be withheld as employees are paid, even on sup-

plemental compensation not paid daily, weekly, semiweekly,

semimonthly, monthly or quarterly. An employer is not

permitted to deduct from the compensation of an employee

just from the last payment for a deposit period; rather the

employer is to withhold from each paycheck issued.

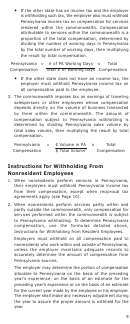

Instructions for Withholding From

Resident Employees

1. When a Pennsylvania resident performs services in

Pennsylvania, the employer must withhold Pennsylvania

personal income tax from the employee’s compensation.

Where the employer is subject to Pennsylvania withholding

requirements and a Pennsylvania resident is rendering

services as the employer’s employee wholly in another

state, the employer must withhold on the entire compen-

sation paid to the employee, unless the other state has

an income tax and the employer is withholding the other

state’s tax.

2. When a Pennsylvania resident is performing services

partly within and partly outside the commonwealth, one

of the following provisions applies:

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24