Form Rev-415 As - Employer Withholding Information Guide Page 12

ADVERTISEMENT

Reciprocal Tax Agreements

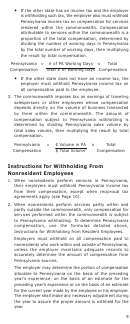

The Commonwealth of Pennsylvania has reciprocal tax agree-

ments with Indiana, Maryland, New Jersey, Ohio, Virginia and

West Virginia. These agreements provide that:

1. If a Pennsylvania resident employee receives compensation

for services performed in one of these six states, the

employer in that state withholds the Pennsylvania personal

income tax from compensation received and remits that

tax to Pennsylvania.

2. If a nonresident employee from one of these states

receives compensation for services performed within

Pennsylvania, no withholding of Pennsylvania personal

income tax is required provided an Employee’s Non-

Withholding Application Certificate (REV-419 EX) is filed

by the nonresident employee with the Pennsylvania

employer. The Pennsylvania employer withholds the

income tax of the state in which the nonresident employee

resides and pays the tax to that state.

CALCULATION OF WITHHOLDING

For each payroll period, an employer must calculate the tax to

be withheld from an employee’s compensation by multiplying

such compensation subject to withholding by the current per-

centage rate, which can be found by visiting the department’s

Online Customer Service Center at A

payroll period is a period for which a payment of compensation

ordinarily is made to an employee by his employer, and payroll

periods may be daily, weekly, semiweekly, semimonthly,

monthly, quarterly, semi-annually or annually. If an employee

receives supplemental or other compensation, an employer

must determine the tax to withhold by adding the supple-

mental or other compensation for the current payroll period

and multiplying this amount by the withholding rate.

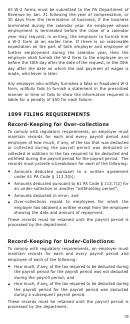

PAYMENT OF TAXES WITHHELD

Every employer withholding tax must pay the tax required to

be deducted and withheld for each quarter to the department

on a quarterly, monthly, semimonthly or semiweekly basis.

The payment schedule is determined as follows:

1. Quarterly: If the aggregate amount required to be

deducted and withheld for each quarterly period reasonably

can be expected to be less than $300, the employer must

remit the tax quarterly on or before the last day of April,

July, October and January for the four quarters ending the

last day of March, June, September and December.

2. Monthly: If the aggregate amount required to be deducted

and withheld for each quarterly period reasonably can be

expected to be $300 or more, but less than $1,000, the

employer must remit the tax monthly on or before the

15th day of the succeeding month for January to

November and on or before Jan. 31 for the month of

December.

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24