Form Rev-415 As - Employer Withholding Information Guide Page 18

ADVERTISEMENT

Participation and Acceptability

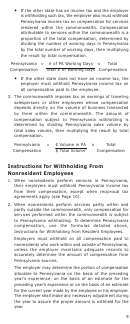

Pennsylvania follows the Social Security Administration's

magnetic media reporting specifications according to the

MMREF-1 format, except as modified and described below.

Filing Requirements

•

Each entity with a unique employer identification number

(EIN) must file as a separate employer.

•

Regardless of the federal due date, W-2s must be filed in

Pennsylvania by Jan. 31 following the tax year being

reported.

•

A transmittal form, REV-1667, must be completed and

submitted with each W-2/1099 report.

°

For example, if submitting reports for 32 different

employer accounts (32 different EINs), it must enclose

32 REV-1667 forms in the same sequence they appear

on the employer’s tapes, cartridges, listings and/or

paper.

°

Screen printouts from e-TIDES are not acceptable

replacements for REV-1667.

•

Employers that file 250 or more W-2 or 1099 forms are

required to file electronically or magnetically.

•

Zip files and magnetic media formatted in American

Standard Code for Information Interchange (ASCII) are

unacceptable and will be returned to the transmitter

unprocessed.

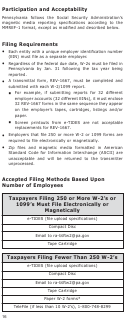

Accepted Filing Methods Based Upon

Number of Employees

Taxpayers Filing 250 or More W-2’s or

1099’s Must File Electronically or

Magnetically

e-TIDES (file upload specifications)

Compact Disc

Email to ra-btftw2@pa.gov

Tape Cartridge

Taxpayers Filing Fewer Than 250 W-2’s

e-TIDES (file upload specifications)

Compact Disc

Email to ra-btftw2@pa.gov

Tape Cartridge

Paper W-2 forms*

TeleFile (if less than 10 W-2’s), 1-800-748-8299

16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24