Form 4584 - Michigan Business Tax Election Of Refund Or Carryforward Of Credits, And Calculation Of Historic Preservation And Brownfield Redevelopment Carryforward - 2014 Page 2

ADVERTISEMENT

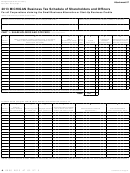

4584, Page 2

FEIN or TR Number

MEGA FEDERAL CONTRACT CREDIT.

If not claiming, skip to line 38.

29. Tax liability before MEGA Federal Contract Credit from Form 4573, line 40 .........................................................

00

29.

30. Unused credit from previous period MBT return ....................................................................................................

00

30.

31. Tax After Previous Period Credit. Subtract line 30 from line 29. If less than zero, enter zero ...............................

00

31.

32. Remaining unused credit from previous period MBT return. If line 30 is

greater than line 29, enter the difference ..........................................................

00

32.

33. Available credit from the MEDC Certificate (attach) ..............................................................................................

00

33.

34. Tax After Current Period Credit. Subtract line 33 from line 31. If less than zero, enter zero here and

complete line 35; Otherwise, skip to line 36 ..........................................................................................................

00

34.

35. If line 33 is greater than line 31, elect a refund or carryforward of credit by entering the difference on either

line 35a or line 35b.

a. Refundable Amount. Carry amount to Form 4574, line 16 ........................ 35a.

00

b. Carryforward Amount.................................................................................. 35b.

00

36. Total Credit Carryforward. Add lines 32 and 35b .............................................

00

36.

37. MEGA Federal Contract Credit. Subtract line 34 from line 29.

Carry amount to Form 4573, line 41 ................................................................

00

37.

BROWNFIELD REDEVELOPMENT CREDIT.

If not claiming, skip to line 56.

Recapture Calculation

38. Tax liability before Brownfield Redevelopment Credit from Form 4573, line 55, or Form 4596, line 19 ................

00

38.

39. If completing Form 4569, enter amount from Form 4569, line 8; Otherwise,

enter MBT Brownfield Redevelopment Credit recapture amount ....................

00

39.

40. Unused credit from previous period MBT return ..............................................

00

40.

41. Subtract line 40 from line 39. If less than zero, enter zero ..............................

00

41.

42. Remaining prior year carryforward. If line 40 is greater than line 39, enter the difference ....................................

00

42.

43. Assigned credit from MBT Brownfield Redevelopment Credit Assignment

Certificate (attach) ...........................................................................................

00

43.

44. Subtract line 43 from line 41. If less than zero, enter zero ..............................

00

44.

45. Remaining assigned credit. If line 43 is greater than line 41, enter the difference ................................................

00

45.

46. Available credit from MBT Brownfield Redevelopment Credit Certificate of

00

Completion (attach) .........................................................................................

46.

47. Subtract line 46 from line 44. If less than zero, enter zero here;

Otherwise, carry amount to Form 4587, line 7 ................................................

00

47.

Carryforward Calculation

48. Remaining current year credit. If line 46 is greater than line 44, enter the difference ...........................................

00

48.

49. Available prior year and assigned credit. Add lines 42 and 45 ..............................................................................

00

49.

50. Tax after available prior year and assigned credit. Subtract line 49 from line 38. If less than zero, enter zero .....

00

50.

51. Prior year and assigned credit carryforward. If line 49 is greater than

line 38, enter the difference .............................................................................

00

51.

52. Tax after Brownfield Redevelopment Credit. Subtract line 48 from line 50. If less than zero, enter zero here

and complete line 53; Otherwise, skip to line 55 ...................................................................................................

00

52.

53. If line 48 is greater than line 50, enter the difference .......................................

00

53.

54. Total Credit Carryforward. Add lines 51 and 53 ..............................................

00

54.

55. Brownfield Redevelopment Credit. Subtract line 52 from line 38.

Carry amount to Form 4573, line 56, or Form 4596, line 20............................

00

55.

+

0000 2014 71 02 27 0

Continue on Page 3.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9